Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs, its innovation arm, which specialises in on-chain risk curation, vault management and DeFi ecosystem design.

> Re7 Capital Website / Re7 Labs website

> Weekly Research / Real-time Insights

> Re7 Capital Twitter / Re7 Labs Twitter

This week at Re7:

Re7 Capital at Digital Assets Summit Europe 2025

Jordan Walker will be speaking on the future of tokenization and real-world asset (RWA) integration in DeFi.Join us in London to explore how institutions are bridging traditional finance with on-chain infrastructure and what’s coming next.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies. Re7 has the following open roles:

Investment Analyst(Liquid Token)

We want to hear from you!

Summary

In this edition, we cover:

Tether stablecoin and market dynamics

Tron’s dominance

The next phase of stablecoin development

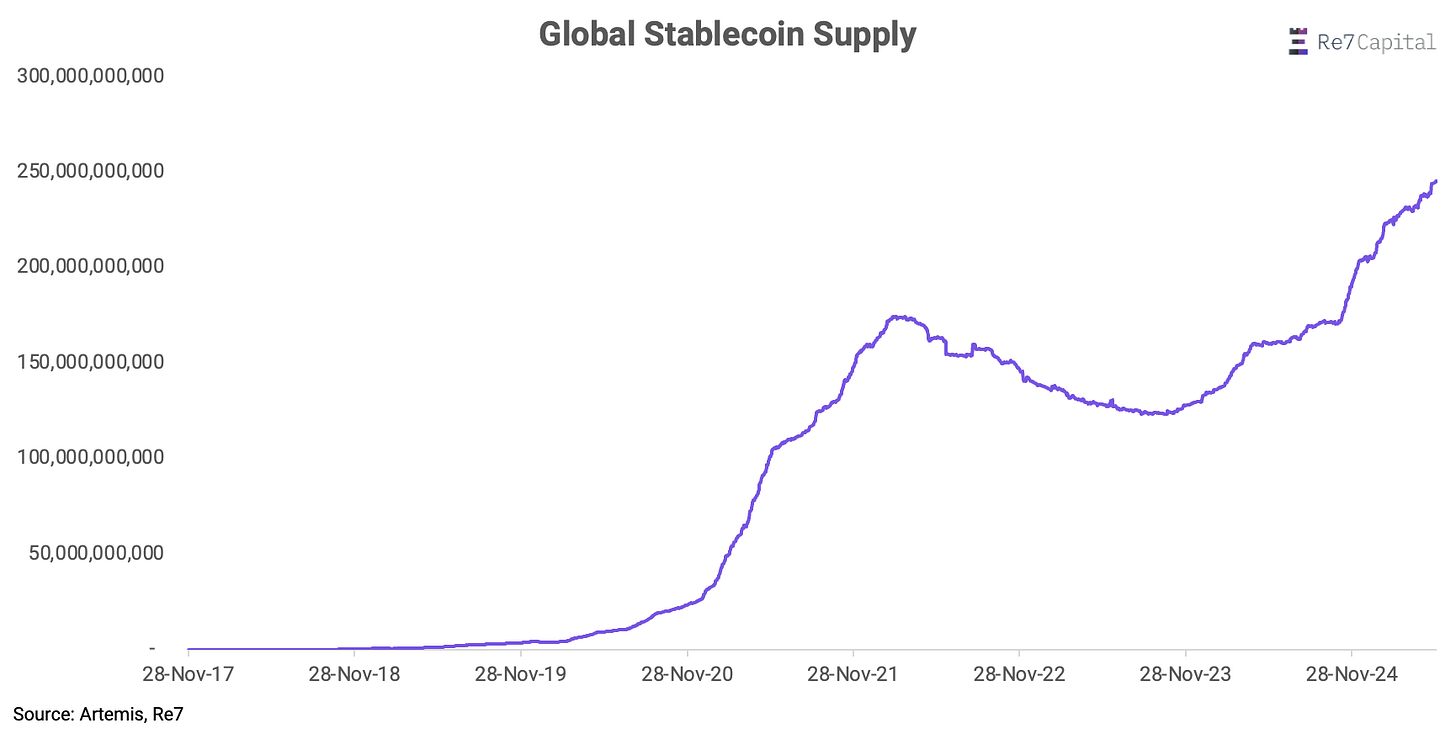

Stablecoin Growth

Total global stablecoin supply has surpassed the 250b mark and on track to reach $300b within the next few months and $400b by year end.

2025 continues to be dominated with stablecoin adoption headlines. To highlight a few:

U.S. Legislation: GENIUS Act advances to regulate stablecoin issuers, aiming to boost U.S. economic dominance.

TradFi Moves: JPMorgan, Stripe, Visa, and PayPal expand stablecoin initiatives; Ethena’s USDe and MakerDAO’s USDS gain traction.

Global Regulation: EU’s MiCA enforces compliance, boosting USDC while challenging Tether; new players emerge in cross-border payments.

Transaction Boom: Stablecoins process $4.7T in 30 days, with strong adoption in Latin America and Africa.

Tether, Tether, Tether

Tether (USDT) continues to reign champion when it comes to supply. At nearly 70%, it continues to maintain its dominance while overall supply has surged.

Tron’s Stablecoin Dominance

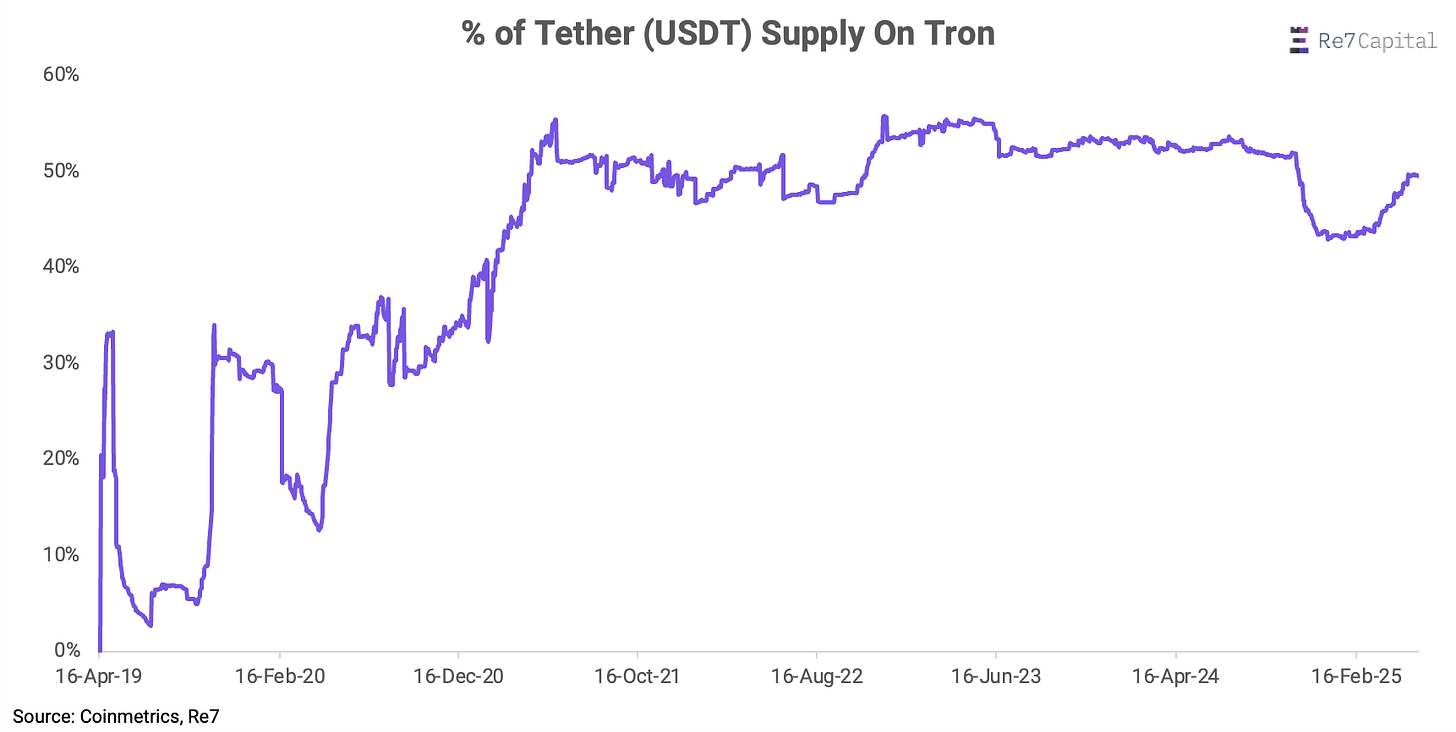

What’s arguably more significant is that nearly 50% of all USDT supply is on the Tron blockchain.

In fact, Tron has just overtaken Ethereum L1 (yet again), for total supply on-chain.

A key reason has been users being ok with simply using Tron’s low (sub $1 fees) and relatively higher throughput capability than Ethereum L1.

USDT is widely used in Venezuela, Argentina, and Brazil for remittances and as a hedge against hyperinflation.

For example, Venezuela’s bolívar instability pushes users to USDT for daily transactions and savings, with TRON’s low fees (under $1) making it accessible. LocalBitcoins and Binance report high USDT trading volumes in these countries.

Users have simply not cared about centralisation issues of the chain. What is more salient is the liquidity, low fees, and reliability.

In fact, maybe to the surprise of many, Tron accounts for >30% of total stablecoin supply globally.

The Next Phase of Stablecoin Infra

This is exactly why we’re seeing the development of stablecoin-optimised chains.

Stablecoin issuers want to take back control of stablecoin economic activity by encouraging economic activity back on their new chain.

Levers they could pull is free transfers for their ‘native’ stablecoin and leverage partnerships for deeper stablecoin liquidity within their ecosystem.

It seems that we’re slowly moving away from the established crypto-native stablecoin issuer on generalised blockchain model to one of specialism.

This could either be TradFi stablecoin issuers (consortium) launching on specialised blockchains or established crypto-native stablecoin issuers develop their own specialised blockchains (e.g. Plasma).

Updates on Re7 Lab Vaults

Backed’s wbCOIN is now live on Morpho Base, curated by Re7 Labs. Users can now borrow USDC against wbCOIN at 86% LLTV

Keep an eye this week on Morpho’s official launch on Plume chain as well, where Re7 pUSD is ready to accept Nest assets nALPHA, nBASIS, nTBILL and nCREDIT as collateral

Make sure to join Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.