Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid venture strategies.

Summary

In this edition, we cover:

The ‘wealth effect’ in markets and the relationship between macro and the ‘cryptoeconomy’

Applying Re7’s Asset Lag Theory to the NFT markets

What areas Re7 is excited about the most given the current NFT market structure

Institutions seeking higher crypto exposure via CME

Market performance dispersion and how its favouring active managers

NFTs and the ‘Asset Lag Theory’

This special edition of The Weekly showcases some of Re7’s NFT theses and a fraction of Re7’s research capabilities that have helped validate our worldview within Web3.

Assets in any economy tend to lag up between 12-15 months+ during every liquidity cycle. More speculative assets, particularly illiquid ones, are the last to react in any liquidity cycle.

This is due to what’s known as the ‘wealth effect’ - the behavioural economic theory that consumers spend more when their wealth increases even if their income does not.

Investors making profits during a constructive market can move into more speculative assets down the risk continuum (i.e. recycling gains) while also selling out of these more speculative assets to achieve liquidity during more distressed periods.

It is this recycling of capital that leads the most speculative assets to peak after the broader market peaks and the last to bottom after the broader market has bottomed.

Second-hand Rolex watches, an illiquid and highly speculative asset, peaked 5 months after the equity market peak in October 2022.

Despite the equity market putting in its 2022 bottom in October, Rolex watches are still yet to carve out their bottom after 14 months but the asset lag theory would put today within the bottoming out window.

At Re7, we see the cryptoasset market as an emerging digitally-native economy.

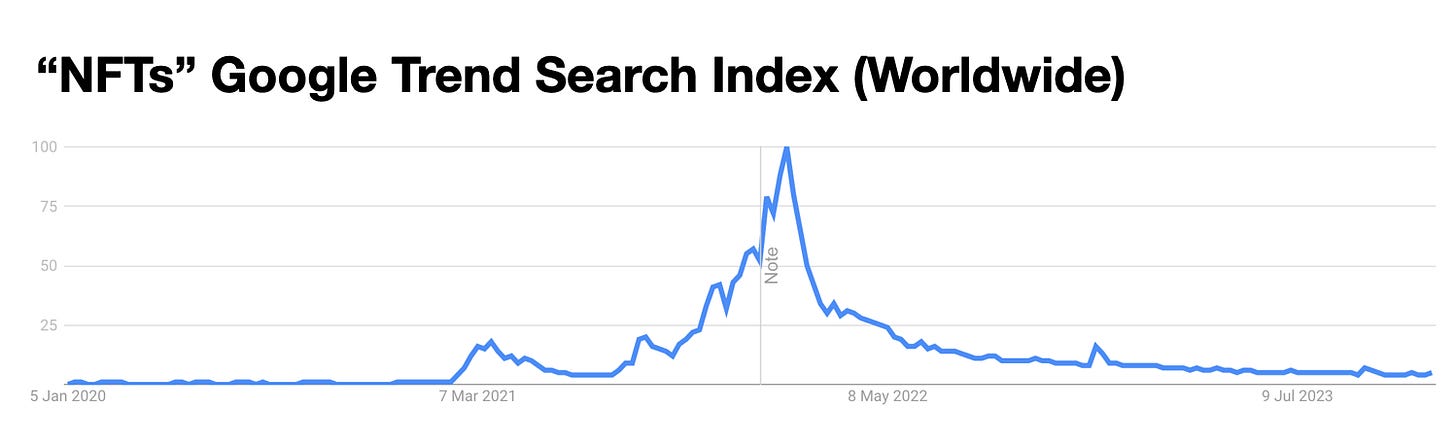

Within the cryptoasset economy, speculative non-fungible tokens (NFTs) fall furthest down the risk continuum for investors. Applying the asset lag theory here would mean NFT floor prices (i.e. the lowest price available in the secondary market) lag the broader crypto market by up 12-15 months.

Just like second-hand Rolex watches, appetite in NFT markets is largely driven by broader macroeconomic dynamics related to spending power - such as disposable income and personal savings rate.

If an investor has lots of liquidity, they are more likely to become active down the risk curve into speculative NFTs. If they need liquidity/are in distress, the opposite dynamic occurs.

We have evidence of this. US Consumer savings rate peaked in April 2020 after stimmy cheques from the Government were handed out during COVID relief efforts.

18 months later, ETH-denominated floor prices of Ethereum-based blue-chip collections such as CryptoPunks peaked in October 2021. Investors were moving down the risk continuum.

But why longer than 12-15 months? The artificial nature, and sheer size, of the stimmy cheques (~$2.3T total) likely accentuated the asset lag effect beyond historical patterns.

Fast forwarding to 2023, we can see CryptoPunk floor prices (ETH) continued to trend down since:

June 2022: When ETH marked its 2022 bottom

November 2022: When the broader crypto market marked its 2022 bottom

Today, we now see life in the NFT market at a time when Re7 marked the 12-15 month window post the ETH 2022 bottom:

So it seems investors are now returning to the NFT market after crypto has been rallying off its bottom for 13 months.

And as we previously highlighted, liquidity is the key driver for investor behaviour and risk appetite. So we should expect growth in measures of liquidity to lead valuations by 12-15 months and that is what the data points to.

Floor value increases come at a time when market liquidity has been experiencing positive growth…

The dynamic can be seen with other blue chip collections. Bored Ape Yacht Club (BAYC) peaked much later than CPs in late April 2021 - 8 months after the broader market peak.

BAYC floor prices are also renewed life during the 12-15 month window, despite peaking much later than other collections. BAYC floor is up 30% from its September 2023 bottom.

And the rise in floor prices is supported by growing volumes across the board (now 4x from September). Investors are becoming more active in the NFT economy and the interest doesn’t just stop at blue chip collections.

The Look-Ahead

We are excited about what the future holds for NFTs. As investor interest comes back to the market, we see opportunities for applications to service the market.

One key market segment Re7 is researching actively is the ‘financialization of NFTs’ - applications that enhance the accessibility, liquidity, or utility of NFTs.

These tools include NFT lending, exchanges, minting, and derivatives with a number recently coming to market at a time when evidence points to investor interest picking up once again.

More applications servicing NFTs will reinforce activity within those markets. It also helps those markets become more efficient over time (e.g. perpetual markets helping with price discovery).

And this all comes at a time when retail has yet to wake up this cycle…

In other words, things are just getting started.

And that creates opportunity.

Spotlight

Re7 Featured on Token Terminal’s podcast, Fundamentals.

Token Terminal and Evgeny dive into the vast arena of DeFi, exploring everything from generating yield to managing risks, discussing the intrinsic value of crypto, how investors should approach valuing multidimensional cryptoassets, and what Re7’s edge is in the space.

Altcoin 7D Performance

The performance of select altcoins over the past week shows clear dispersion.

The performance range using the example above is -5.13%-40%.

A rising tide doesn’t necessarily lift all boats the same. Active managers have the advantage of identifying high-quality names supported by fundamental and catalyst-based research.

Global Market Cap

$1.5T; Markets are up 5% over the last week with likely next key resistance at $1.66T (+10%).

ETH/BTC

0.0539; ETH/BTC still kept within its multi-year wedge pattern and has been trading in line with its ascending support over the last few months.

DeFi

$61.3B; DeFi market capitalisation breaking out of the recent consolidation area of $55B but still 3x off its ATH in 2021.

Altcoins

$287B; The broader altcoin market has yet to make a move like DeFi after consolidating at ~$300B. Technicals point to neutrality and path of least resistance is likely up, not down, in the current market structure.

Bitcoin Dominance

BTC.D; Bitcoin dominance ticking higher as rebuttal comment deadline for a number of spot Bitcoin ETF applications has been defined (Jan 8th-10th). Bitcoin dominance could remain elevated until those dates with the spot Bitcoin ETF speculation remaining on everyone’s radar.

Trader Positioning

BTC; CME open interest (OI) reaches new ATHs (116k). CME is an institutional-centric exchange and signals a growing bid from those market participants into BTC/crypto.

CME has now topped the leading retail exchange market, Binance, for OI (108k).

CME contracts rolled at 23% annualised at time - i.e. investors are paying handsomely to roll their contracts forward in a sign of growing commitment by asset managers to accumulate BTC/crypto exposure.

> Investing in DeFi with Re7 Capital [Token Terminal]

> Building Modular Move Network on Ethereum [Empire]

> On Celo [Epicenter]

> Decentralising AI with Bittensor [Delphi]

> EigenLayer at Devconnect [Zero Knowledge]

> Reserve Currencies [Brian Armstrong]

> Neutron x Mars [Neutron]

> Franklin Templeton CEO holds bitcoin, ether, and Uniswap and SushiSwap tokens [The Block]

> Osmosis and UX Chain propose merger within Cosmos ecosystem [The Block]

> Bitcoin Transactional Activity [Charles Edwards]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.