Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Announcement! NEW Re7 Alpha Telegram Group

We're starting invitations to a new Re7 Alpha Telegram group. This will be an anonymous group with regular updates on the best DeFi yields, Re7 Labs updates and first information about cap increases or other opportunities in our vaults.

Here's what you can expect:

Stay Updated: Get the latest news, announcements, and updates on our vaults and the DeFi ecosystem.

Access Exclusive Insights: Gain early access to new vault launches, exclusive offers, and insights from our team.

Our Goals:

Sustainable Growth: We want to showcase our priorities long-term growth and sustainable yields.

Community & Partnerships: We're actively seeking to engage across the space and explore strategic partnerships to offer innovative solutions.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies.

Investment Analyst (Liquid Token)

Re7 is searching for an Investment Analyst - someone who will be working directly with the Liquid Alpha leadership team scout deals, diligencing opportunities and investments, as well as developing overarching investment theses.

Re7 is searching for a DeFi Developer to support the Re7 tech team, developing and maintaining key backend infrastructure for Re7 products and funds.

Summary

In this edition, we cover:

What’s moving markets today

The normality of market drawdowns

Divergences emerging from valuations to industry and sector KPIs

Non-Linear Paths To Exponential Growth

Digital assets markets retreat after its +70% climb since the US election in November. Global market capitalisation now stands at $3T.

There have been strong bids at levels marked by the first consolidation area post US election. Markets are, so far, still pricing in a positive regime change for digital assets with Trump at the helm.

Drawdowns Are Part of the Game

Negotiating with countries via tariffs by the US has been increasing anxiety around slower economic growth and higher inflation that may challenge an accelerated rate cut path.

Yet, just one day after the tariff turmoil, markets remain unchanged. A tactical bounce after a series of major liquidations - not seen unless over extreme scenarios (e.g. COVID) was in order.

The bids were just as impressive as the extent of liquidations.

It’s helpful to zoom out and see drawdowns >15-20% are frequent. In fact, they are normal.

BTC is an asset with annualised vol at 30-50%. We see many examples of these drawdowns during bull markets.

Despite these drawdowns, the rolling 4 year performance of digital assets (BGCI here as proxy) for the past 8 years is positive. Upside volatility is accompanies by downside volatility.

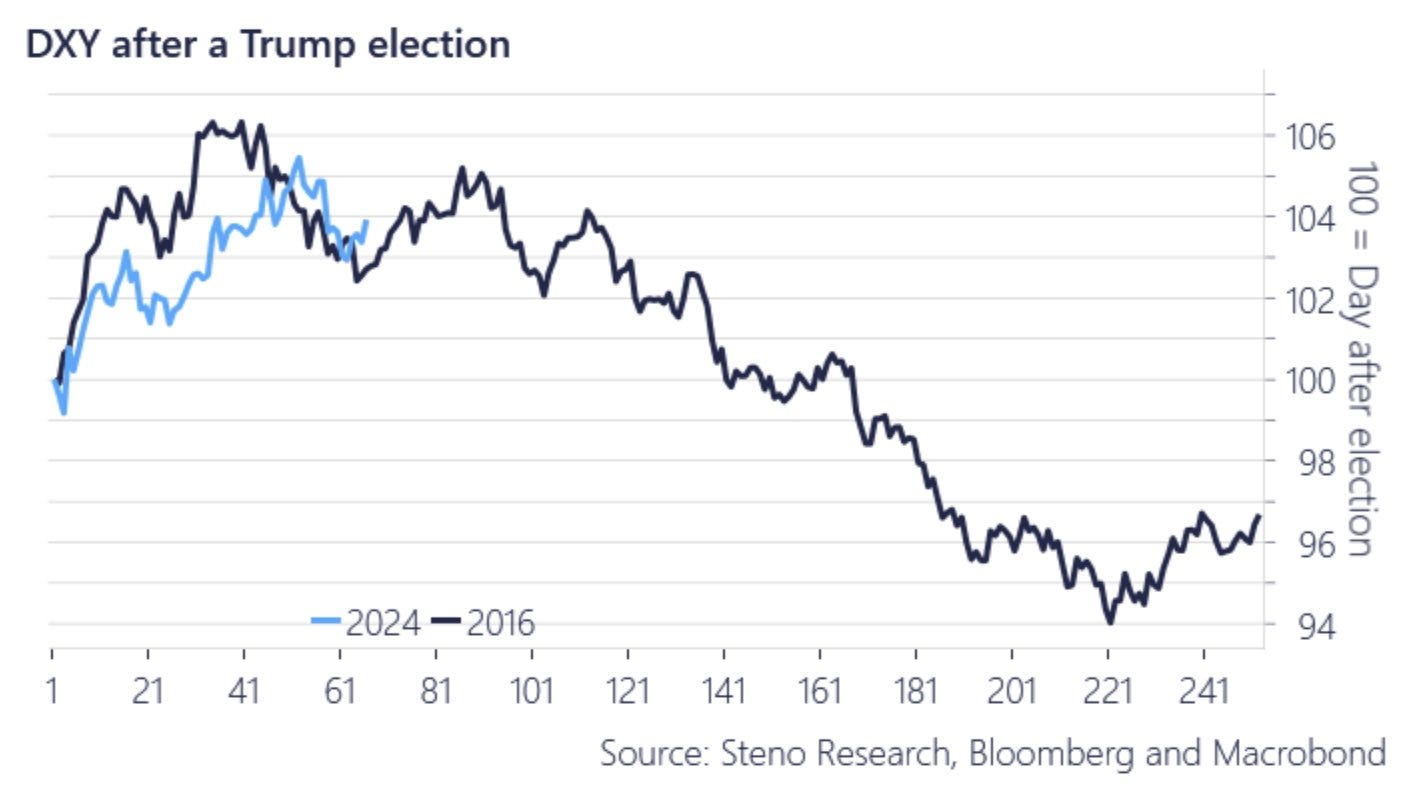

And with dollar strength acting as a headwind for risk assets for now, the current trajectory is nothing out of the ordinary from the last election…the broader trend is one of a weaker dollar over time, not a stronger one.

Lower dollar, looser financial conditions.

Divergences with KPIs

Still, markets may have got overextended already.

Taking a Metcalfe’s law lens (value of x proportionate to the square number of active participants), valuations have already dipped materially below on-chain active user base.

For a number of sectors, we’ve seen little change over the volatility. Take lending. Global borrows remain at cycle highs - $22.5b. Yet, we are now seeing a divergence in valuation to borrow amounts this cycle.

These volatile periods also present a wide-range of yield opportunities. For example, arbitrage strategies for stablecoin de-pegs.

In recent hours, stETH/ETH temporarily de-pegged by 1.5% from sellers exiting in a illiquid market only for the peg to move back closer to par.

Volatility often present investment opportunities for many types of strategies.

"Inspiration Exists, But It Has to Find You Working"

- Picasso

And sometimes it helps to zoom out not miss the forest for the trees for finding that inspiration…

Symbiotic Vaults x Re7 Labs

Symbiotic is now live on Ethereum mainnet and Re7 Labs is excited to join the modular restaking party with not 1 but 2 wstETH vaults!

We announced last week our partnership with P2P to be curators of the rstETH restaking vault on Mellow. You can deposit into our curated LRTs Re7LRT (~$12m TVL) and rstETH (~$90m TVL).

We’re supporting the majority of networks that went live on Symbiotic such as CycleNetwork, CapX, Kalypso, Symbiosis, Hyve and many more.

Only new vaults on Symbiotic get points so depositors should migrate soon to get max exposure

Links to our Symbiotic vaults:

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.