Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

We’re Hiring!

Re7 is searching for an Investment Analyst and a DeFi Research Analyst!

If you are insanely passionate about crypto; if you can’t imagine NOT playing with every new Web3 platform that pops up; if in the last year you spent more time in web3 than outside - then we want to hear from you!

Apply here!

Summary

In this edition, we cover:

How Biological mechanisms can teach us about the importance of adaptability for decentralised blockchain networks

3 examples of how adaptability applies in Web3:

Enabling product strategy resilience

Expanding the scope of operations

Generalised services encompassing new markets

The future of adaptability through the use of autonomous agents

Biology as Technology, Technology as Biology

American scientist Ryan Bethencourt once said:

“Our world is built on biology and once we begin to understand it, it then becomes a technology.”

Over the years, I’ve come to realise that Bethencourt’s assertion applies to businesses and human-developed technology too.

As with the theory of evolution, those businesses that are best adaptable to challenges will be the ‘fittest’ operators that stand the best chance of survival in the future.

If a founder doesn’t find a product-market fit for existing or new customers, they must adapt to the reality and pivot their strategy accordingly.

On Adaptability in Web3

Decentralised blockchain networks exhibit evolutionary-based dynamics too in their own way - they can be considered organisms that look to colonise their niche (i.e. dominate a market).

But when environmental pressures arise (e.g. competitors, macro, regulation), these open-source networks have to adapt to these challenges through specific coordination mechanisms to survive.

At Re7, adaptability continues to be a key investment framework in which we evaluate each opportunity and market.

Operating in an open-source environment means adaptability is an increasingly important factor to evaluate.

Below are some examples of how blockchain networks can respond can, have responded, ‘in the wild’ over the years.

Product Strategy Resilience

One adaptability mechanism is to ensure product strategy resilience.

Certain environmental changes may be conducive to certain products while challenging others.

Take Maple - a capital market network.

Maple began offering uncollateralised lending where credit pool delegates underwrite loans.

As interest rates rose in 2022 and the collapse of firms like Alameda (i.e. the environmental pressures), total loans outstanding in these pools (grey colours) shrank considerably.

Yet, higher rates provided opportunities for Maple to capitalise on such as t-bill and other RWA yield opportunities for on-chain capital.

Products like Maple Direct and Cash Management (pink colours) began to drive the majority of loans outstanding.

Yet, nominally high rates are still posing a key environmental challenge for Maple today with loans outstanding far below pre-2023 levels.

Expanding the Scope of Operations

Keeping on the theme of real-world assets, the stablecoin protocol MakerDAO showcased how higher rates could enable further growth beyond its core offering.

DAI stablecoin supply backed by RWAs overtook non-crypto-backed DAI in the months leading up to the peak in rates - peaking at 3.38B.

Through forming mutualistic relationships - such as Centrifuge - MakerDAO was able to drive annualised fee income from $11m to $246m since October 2022.

The net effect is higher stablecoin supply, making DAI more relevant in the niche in which it operates - the stablecoin market.

Maker’s endgame also showed how decentralised networks can specifically work to overcome stagnation and coordination problems within DAOs.

Generalised Services Encompassing New Markets

In some cases, environmental pressures are not negative but present an opportunity for positive adaptability.

Take Gearbox - a composable leverage protocol that allows users to leverage on any market.

The generalised service is composable credit. The product is the Gearbox ‘credit account’. The credit account is like a prime brokerage account where a user can achieve higher buying power (leverage) through borrowed funds with collateral.

Previous targetted markets for Gearbox users included margin trading on DEXs like Uniswap.

More recently, Gearbox’s composable credit service was extended to Eigenlayer derivatives.

Users can borrow ETH and lever up on liquid restaking tokens by up to 9-18x via Ether.fi and Renzo.

TVL for Gearbox has just breached $100m and on course to generate $15m in fees for lenders.

For the Gearbox team, their ‘Network Effects’ capture strategy speaks directly to the importance of positive adaptability.

A modular protocol can remain relevant by tapping into those markets most relevant to users. After all, remaining relevant in your market can inform KPIs including financial health - where sufficient revenue is generated to fund future adaptability.

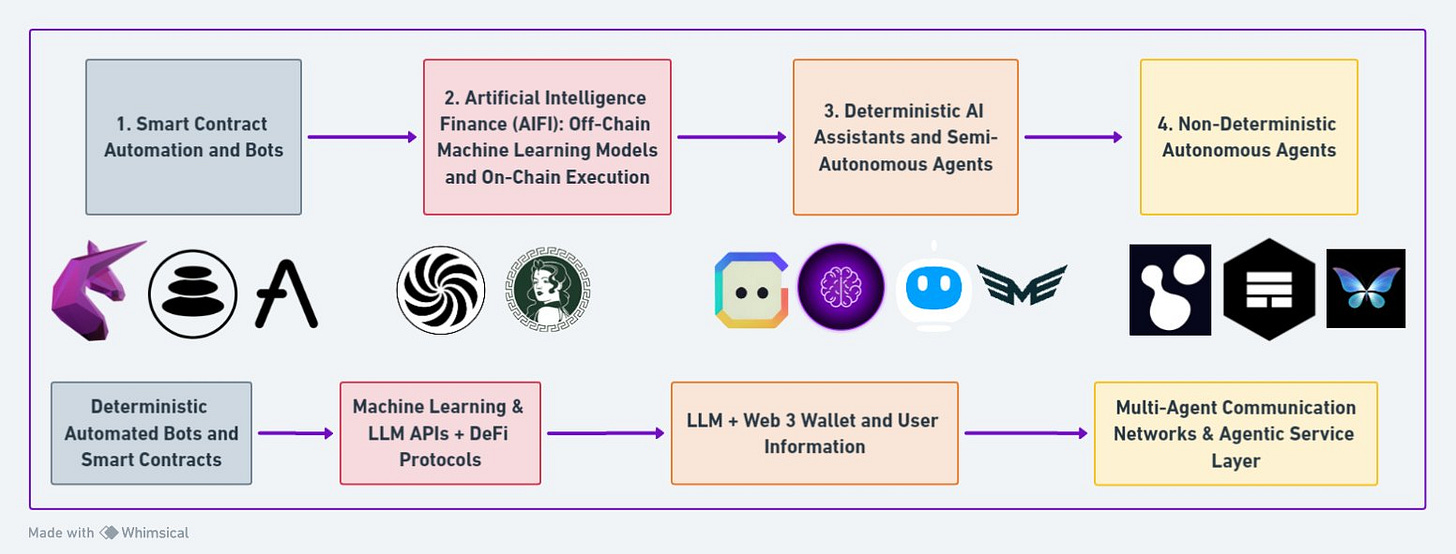

Future Adaptability: Autonomy

The notion of adaptability for decentralised blockchain networks will only become more relevant, automated, and cross-sector.

For example, take non-deterministic autonomous agents in Web3. They represent intelligent systems making decisions and executing tasks using smart contract environments that are dynamic in nature.

Take prediction markets. Autonomous agents can run markets that search the web for relevant markets and specify/update odds in real time.

The adaptability here refers to processing new information and adjusting processes among other agents. Unlike the previous examples, adaptability comes from code, not humans.

But the maxim of adaptability is still the same. Agents failing to adapt to ongoing challenges are ‘less fit for survival’.

Not inputting key external information to update the pricing of a prediction market drives users away from competitors that provide a more effective product.

The ‘fittest’ agent networks will always stand the best chance of survival.

Leverage Restaking Market

The points farming frenzy continues as more protocols add the ability to leverage farm Liquid Restaking Tokens.

What started with Pendle fixed yield markets has expanded to almost every corner of DeFi as degens look to profit from the expected airdrop of Eigen Layer and related restaking protocols.

What's the play? By borrowing ETH or other assets against Liquid Restaking Tokens, users can leverage the loop in a similar strategy to the popular trade of leveraging staked ETH tokens.

However, the expectation of a future token airdrop has meant borrowers are expecting more upside and as a result are willing to pay much higher rates.

For holders of Liquid Restaking tokens like eETH, ezETH and others, there is now a wide range of options to access leverage on your LRTs.

One of the cheapest so far has been Morpho, where the Re7 WETH vault has allocated over 2/3 of the supply to LRT markets.

The result is low borrow rates on markets like ezETH that launched last week. With a target rate of under 5% and effective available leverage of up to 7x, we expect the available liquidity to get quickly utilized.

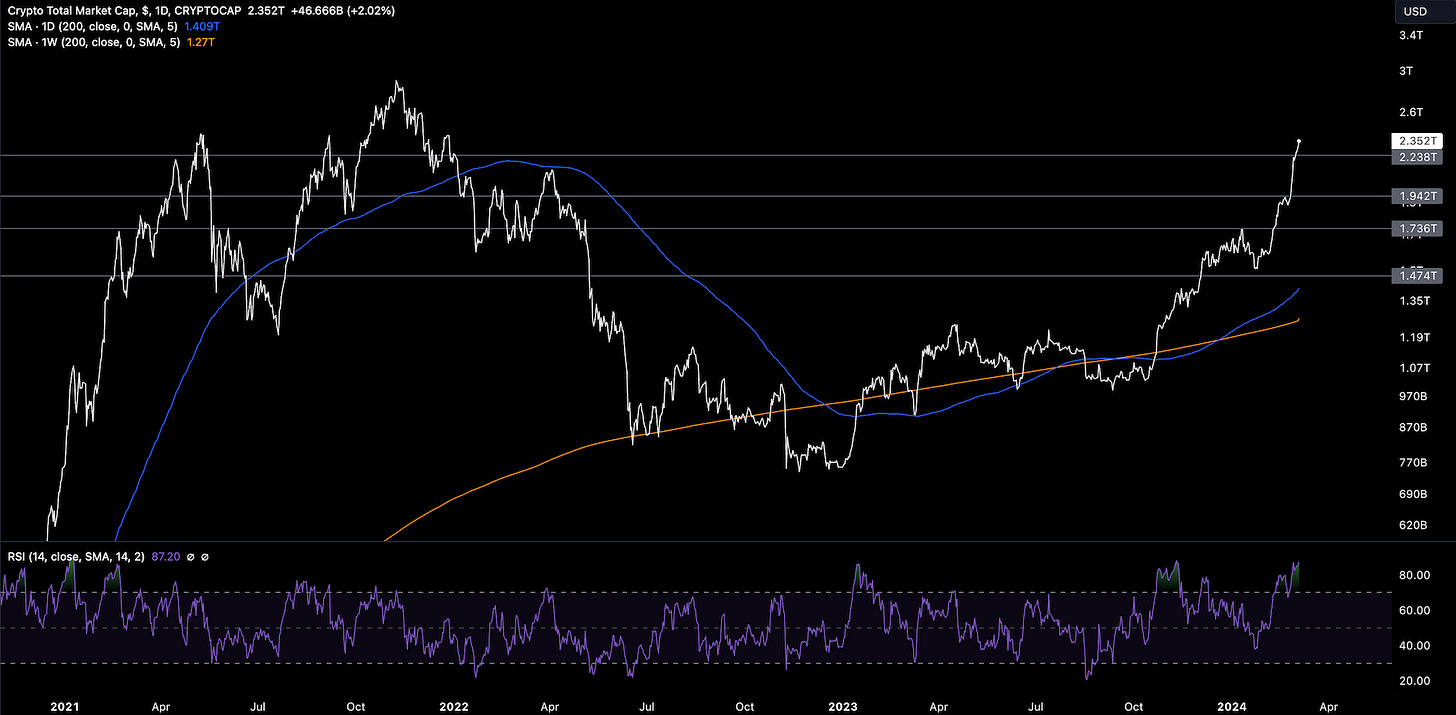

Global MCAP

$2.35T; Global market capitalisation breezes through $2T last week with a weekly gain of 18.8% - the largest weekly gain since April 2021. Markets continue the week green (+2%), now hovering 23% below ATH levels.

ETH/BTC

0.0382; ETH/BTC being challenged once again with structural inflows into BTC from US spot ETF launches. Ratio now just 7% above key 0.05 support level heading into Dancun upgrade 13th March. Still kept within its multi-cycle wedge.

DeFi/ETH

$24.74B; DeFi struggling with beta strength (ETH) since the launch of the ETFs earlier in January. Yet, the DeFi sector has still grown 52% over the same period ($103B), extending the strong momentum from 2023 lows in October 2023.

Global Spot Exchange Volume

$73B; Daily exchange volume has 3x since Feb and now reaching fresh highs since may 2022. Bull market sentiment, price action, and ETF inflows have been key drivers for volume expansion over the last few months.

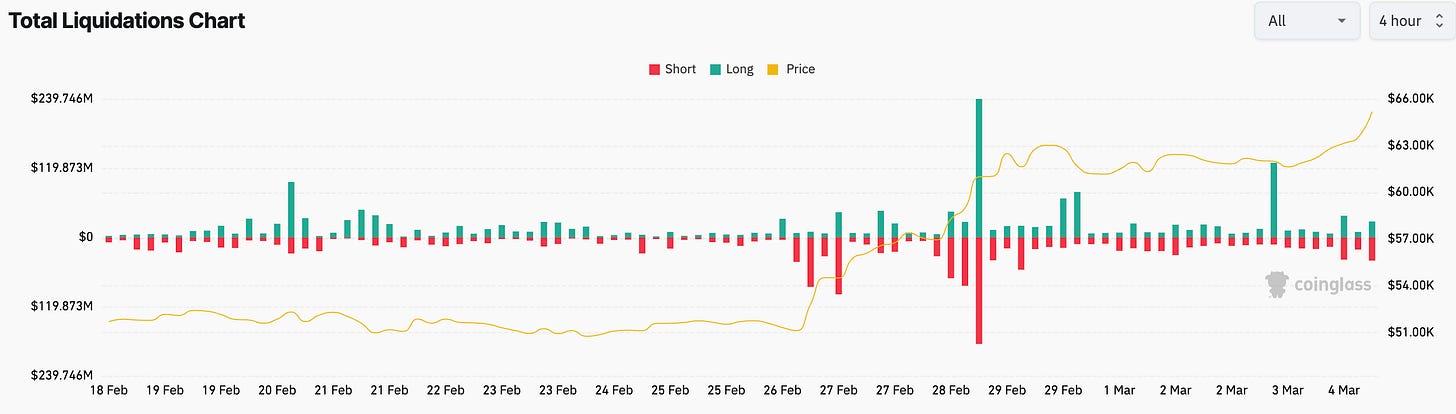

Futures

We’re still seeing futures liquidations continue on the short side adding to volatility in recent days. $180m in long liquidations yesterday (3rd March) which has done little to sustain lower prices in BTC.

Global open interest reached $27.53B - an ATH level.

ICYMI: Re7’s Latest Contribution to OurNetwork

> Onboarding users to Ethereum [ETHDenver]

> How intents solve interoperability [ETHDenver]

> How to improve crypto security [Unchained]

> Who are the real users in crypto? [Lightspeed]

> Building on Bitcoin Lightning Network [The Fintech Blueprint]

> BlackRock iShares AUM [zerohedge]

> Trump MAGA Meme Coins Are the First Experiment in 'PoliFi' [Coindesk]

> Ethereum memecoins go viral with $6.4bn traded in February [DLNews]

> Crypto Asset Flows [Unfolded]

> ETH Supply [Ultrasoundmoney]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.