Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

This week at Re7:

SocialFi $10M Fund Launched

We’ve officially launched our $10 million SocialFi strategy—targeting one of the fastest-growing sectors at the intersection of crypto, creator economy, and on-chain engagement. Covered by The Block and announced on X.Private Leadership Breakfast — Dubai

In the heart of Dubai, we hosted an invite-only breakfast with key decision-makers shaping the future of digital finance. See highlights.Evgeny Gokhberg at HFM Middle East Summit

Our Managing Partner, Evgeny Gokhberg, will speak at the HFM Middle East Summit on how digital assets, AI, and emerging technologies are redefining global capital markets. Learn more.Mar-a-Lago: A Gathering of DeFi Leaders

Re7 was honoured to be part of an exclusive private gathering at Mar-a-Lago, alongside some of the industry's foremost DeFi minds. View post.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies. Re7 has the following open roles:

We want to hear from you!

Summary

In this edition, we cover:

The latest headlines showcasing institutional adoption of Web3 and tokenisation of RWAs

The accelerating growth of RWA value on-chain

The growing significance of public blockchains underpinning RWA growth

Institutional

There was no shortage of real-world tokenisation adoption headlines this week, following an already headline heavy month.

We already had BlackRock tokenise money market funds to the Solana blockchain while AT&T partnered with Helium network to utilise Helium’s decentralised network to support its mobile service area for its 100m+ subscribers.

This week, more tokenised yield products were being launched on alternative blockchains like TON.

Libre, is planning to tokenise mid-nine figures of tokenised Telegram bonds on the TON network.

BlackRock made further moves, issuing a new digital asset share class for its $150B Treasury Trust fund.

Why? Blockchain enables enhanced efficiency and faster settlement times, increased transparency and record-keeping, and automation via low cost reconciliation

But it’s not just financial institutions. Major sport associations like FIFA announced they would be creating their own blockchain to enable ‘long-term growth’ of their Web3 initiatives including NFTs.

As we’ve highlighted before, tokenization is happening not for its own sake but because it unlocks greater utility for assets.

The practical benefits are significant with RWA value on chain on its way to reaching $25B within the next 2-4 months at current pace.

We are already seeing the net impact of these institutions wanting to move value on-chain.

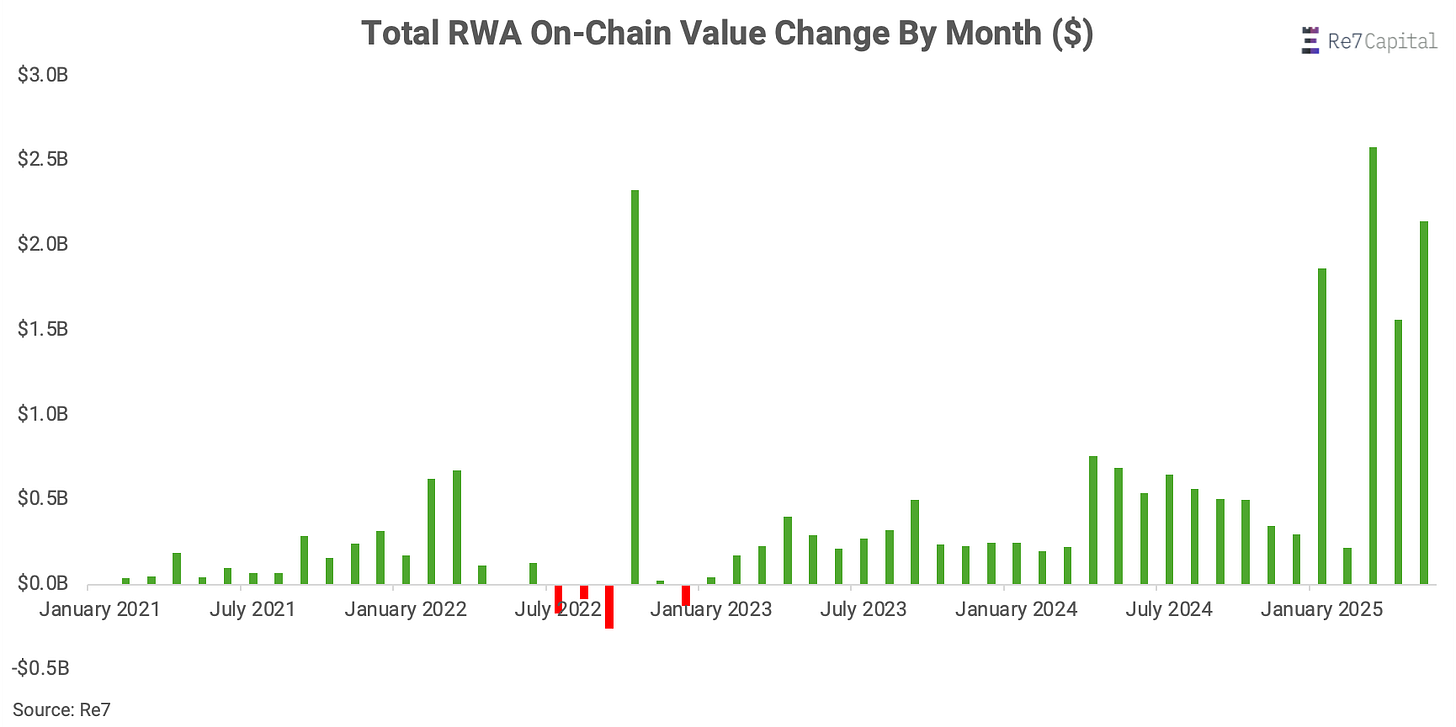

Looking at the month-on-month dollar change in total RWA value on-chain, we can see growth is accelerating at a significant rate.

And this growth is supported by a diversified list of asset classes. The benefits of tokenisation isn’t bound to one variant.

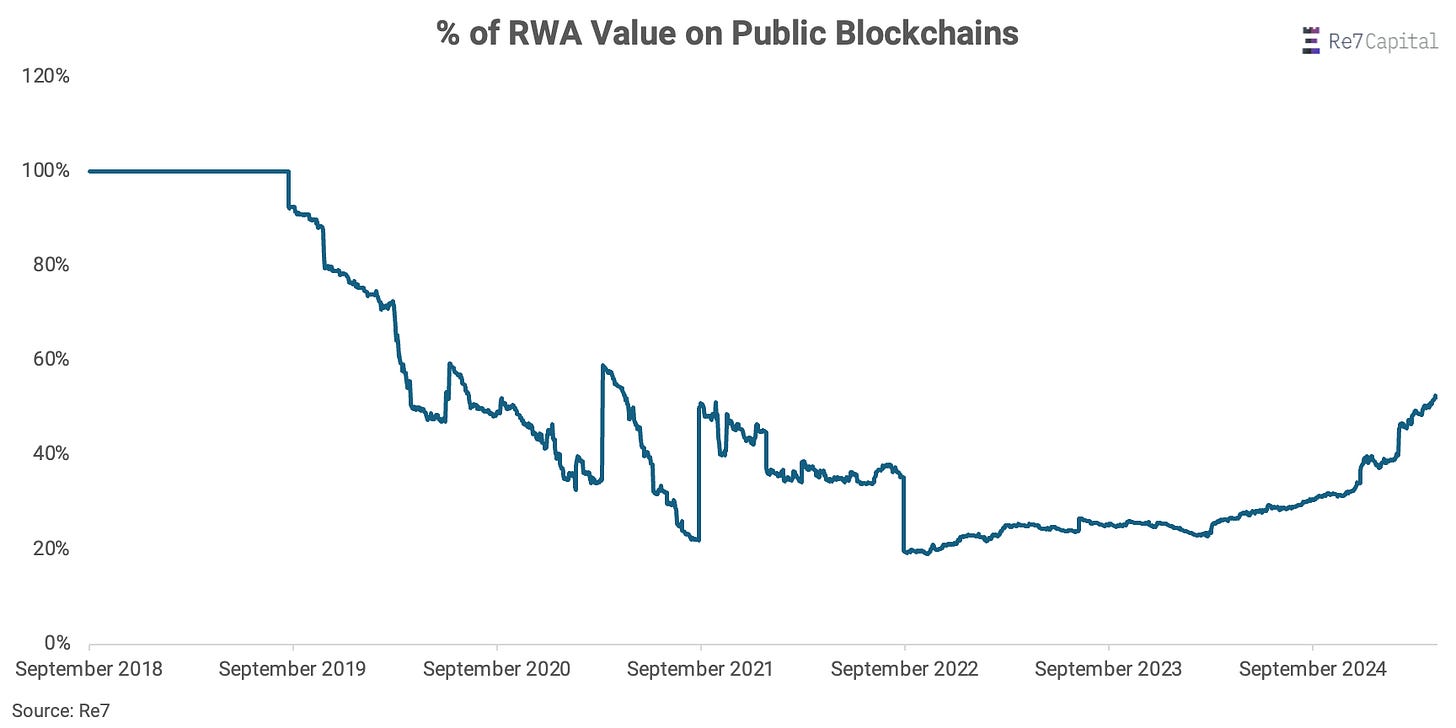

The percentage of RWA value on public blockchains vs. private ledgers has increased significantly over the last year to 50% as RWA value has increased nominally.

This comes after private ledgers once dominating 80% of the total market and could be an early signals of public blockchains being the preferred rails given the greater accessibility, liquidity, interoperability, and decentralised security they offer.

Updates on Re7 Lab Vaults

Re7 Labs vaults have surpassed $400M in TVL!

Aggregate TVL in vaults curated by Re7 Labs is now higher than $400m. Some of our Top-performing vaults include:

Euler Berachain WBERA – up to 95.67% APY

Euler Mainnet AUSD – 65.63% supply APY

Turtle Club tacETH – up to 32.58% APY

Explore all our vaults and make sure to join the Re7 Labs Alpha TG for all the insights

TVL on World Chain increased by ~$20m in less than 5 days fueled by the launch of Morpho vaults (curated by Re7 Labs) and $5M in $WLD rewards via Merkl.

Explore the yields and try it out via the Morpho Mini App

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.