The Weekly - 6th November 2023

On Bitcoin fundamentals, decentralised exchanges, and Solana TVL.

Stay informed about what really matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid venture strategies.

Summary

In this edition, we cover:

Bitcoin’s strengthening fundamentals and why it matters for economic activity and network valuation.

The relative growth of decentralised exchanges (including spot and perpetual).

The growing relevance of Solana as an ecosystem.

The technical breakout of key market ratios and sectors.

Bitcoin

Bitcoin printed its 3rd consecutive positive week (+1.34%), topping out at $36k - a new high since May this year. We saw several signals that pointed towards Q4 seasonality last month and it appears that’s now in full swing.

Liquidations and spot Bitcoin ETF news momentum have been key drivers of performance but we believe the market is missing the on-chain dynamics supporting the recent upwards move.

Headline metrics like transaction count have surged to just below ATH levels (700k/daily) printed in September 2023.

A higher tx count has corresponded to higher fees (excluding block rewards) for miners, surging to $2.8m which now represents ~7% of total miner revenue.

Higher revenue coupled with supportive BTC market value is creating a healthy mining environment.

Hashprice, the expected value of 1 TH/s of hashing power per day, has climbed to a 4-month high of $76.

Another hashprice measure that Re7 measures (miner hashrate/price) is also falling (blue; inverted). We see hashprice as topping out (1 year rate of change) for this cycle where a collapse in hashprice will coincide with supportive BTC price action.

But where is this surge in economic activity coming from?

The number of BRC-20s inscriptions, a fungible token standard on Bitcoin, which requires transactions and fee payments to mint is now contributing ~400k txs per day.

~24 BTC are paid for BRC-20 related transactions representing 26% of all miner’s tx fees. Today, over 1.7k BTC has now been paid to miners since March 2023.

Our key takeaways here are that Bitcoin’s fundamentals are strengthening, offering a path for long-term economic sustainability, and paving the way for an expressive ecosystem around BTC and BTC-related assets.

Finally. all three are interrelated and lead to more ‘economic throughout’ of the system. This has direct implications for valuation models that use measures of economic activity as key inputs.

Re7’s Economic Activity Valuation Index (EAVI) ticked higher last week corresponding with BTC’s move higher further demonstrating the link between economic activity and network valuation.

Exchanges

After falling 83% from its peak in November 2021, Decentralised Finance (DeFi) has rebounded 68% to regain its $50B market capitalisation. Just like with Bitcoin, it appears the market is now sniffing out specific fundamental growth that can no longer be ignored.

One area within DeFi that has gone from strength to strength despite the extended bear market is exchanges.

For spot markets, volume on Decentralised Exchanges (DEXs) is now outpacing their centralised peers, now accounting for 15% compared to 8% this time last year.

Increasingly efficient exchange designs, the proliferation of lower-cost scaling networks for users over the past year, and the fallout of FTX, have collectively driven peak interest in non-custodial solutions.

This is starting to carry over from spot to perpetual exchanges too. For example, Bitcoin perp volume on DEXs (e.g. Synthetix, GMX, dYdX) is now outpacing centralised counterparts with the ratio printing higher lowers since summer 2023.

The growing dominance of perpetual swap protocols is driving proportionally higher on-chain revenue. Take Synthetix - the longest-standing derivative protocol - which is now generating $4B and $3m in monthly volume and fees, respectively.

Volumes are now ~12x compared to this time last year with annualised fees nearing $38m.

In Synthetix’s case, the improved matching engine brought in between buyers and sellers for V2 at the end of 2022 was the key enabler for volume growth. With Synthetix V3 on the horizon for YE launch, we expect Synthetix volumes to consistently reach $10B in monthly volumes.

Like the spot markets, the continued work towards more capital-efficient and scalable design has started to change the game for users.

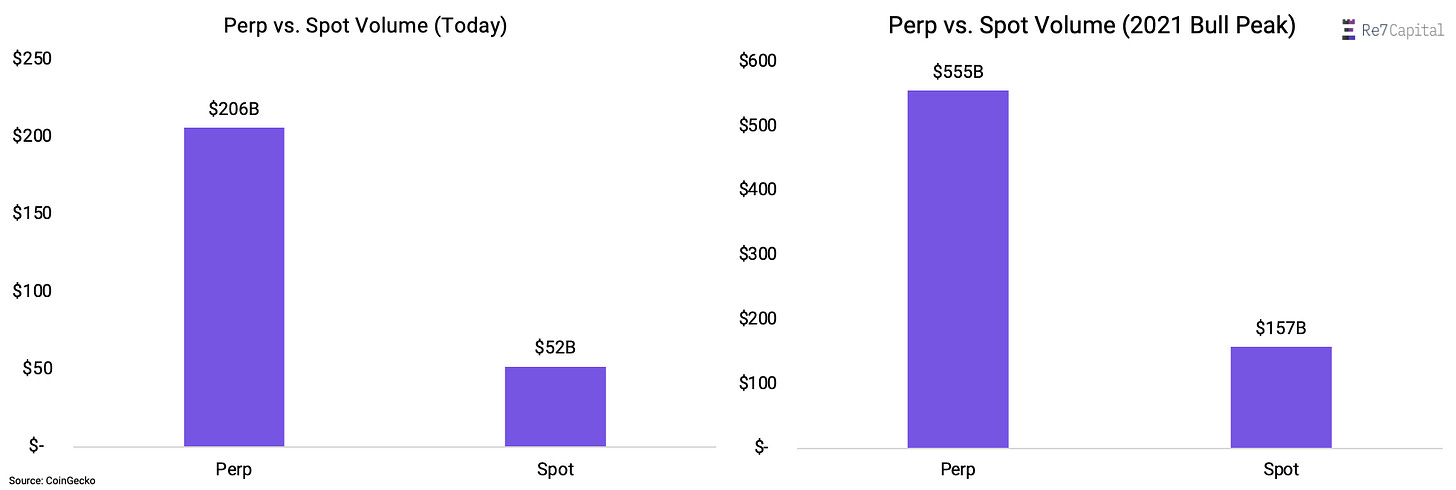

But unlike spot, the perpetual swap market opportunity is much larger.

Perpetual volumes represent ~3.5-4x of the volume and put in a peak of $555B during the 2021 bull market peak vs. spot’s $157B.

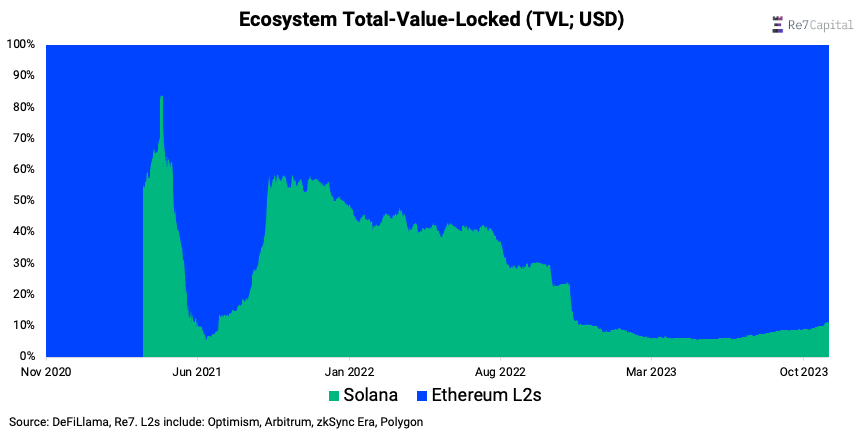

What is it? The market share of total-value-locked (TVL) between Ethereum scaling ecosystems and Solana.

What’s the significance? Ethereum’s scaling solutions are promised to solve for Ethereum’s scaling requirements. Yet, Solana has started to outpace the collective TVL of Ethereum’s scaling solutions consistently since the summer.

Drivers include the PMF of select applications (e.g. LSDs) and the increased value of SOL as a core collateral asset within Solana DeFi. The latter, in turn, has been supported by the Solana Breakpoint Conference where significant scalability improvements to the network’s TPS have been presented (see Firedancer).

Enhancing Solana’s architecture has the potential to unlock new markets that can operate on-chain in a post-Firedancer world and attract liquidity/users from other ecosystems. For these reasons, we see the SOL/L2 TVL ratio increasing further to 30%+ in 2024.

ARB STIPs

Arb incentives for the STIP grants start this week.

Why? Arbitrum is embarking on its first grants program, distributing 50 million ARB to a wide range of projects on the chain. Projects received their first tranche of ARB tokens over the weekend and will start distributing them to users in various programs starting this week.

Where's the alpha? ARB will be passed through to users in a wide range of mechanisms depending on the project, but all ARB will be used in the next few months, so expect the yield to be even higher on Arbitrum in the coming months.

Global Market Cap

$1.30T; Markets were up 3.7% last week, printing a 3rd consecutive positive week. Global MCAP appears to be in an ascending wedge, now hitting an area of near-term resistance as assets become overbought.

The US treasury is slowing the pace of issuing longer-date debt meaning it expects interest rates to decrease over the the next few quarters.

Lower highs have been put in since summer as macro tailwinds and potential for US spot ETF approvals are potentially on the horizon. We continue to see investors starting to price in the liquidity growth picture that these macro events are starting to signal.

DeFi

$51.5B; DeFi market capitalisation breaching $50B for the first time since April 2022 as investors start to refocus capital in the sector. Key test area where a breach of the wedge to the upside would signal more sustained momentum to the upside into YE.

Altcoins

$270B; The altcoin market capitalization has surged to new highs since April 2023 indicating increasing relative momentum of assets outside of beta + stablecoins.

Note, this can be influenced by the launch of new altcoin networks (e.g. Celestia) but at the very least shows how alts are becoming a more meaningful part of the market once again.

SOL/ETH

SOL has now outperformed ETH 3x since cycle bottom with the SOL/ETH ratio putting in a new high since September 2022 (effectively reversing the post FTX relative drawdown).

Trader Positioning

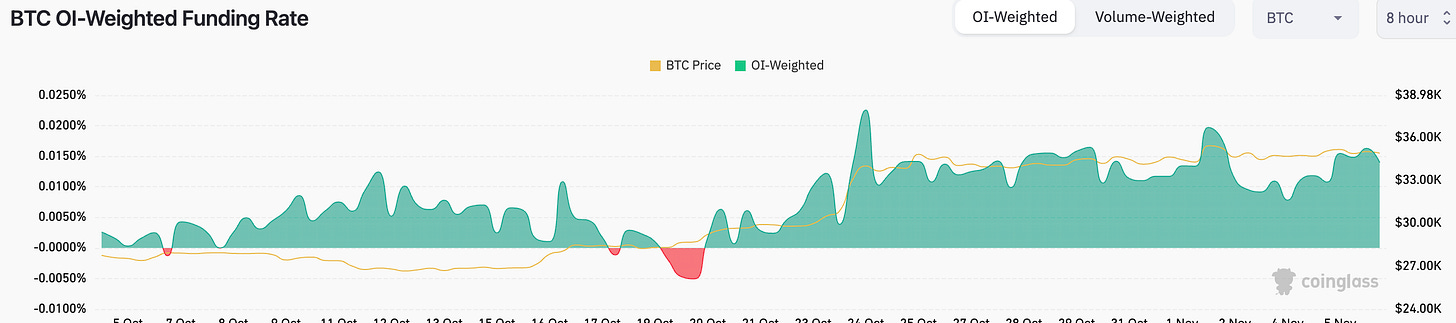

BTC; Aggregate perpetual funding rates have remained firmly positive since October 23rd when BTC closed above $30k.

Futures market heat indices point to an overheated dynamic today implying a potential pullback.

Grayscale Trusts

GBTC

GBTC’s discount to NAV narrowed to 12.7% supported by growing conviction of a Grayscale spot ETF conversion and higher BTC/USD ratio.

ETHE

ETHE’s discount to NAV also narrowing (21%) with several spot ETF application being submitted to the SEC.

Expected deadlines on filed applications to be around ~May 2024.

> The State of zkSync [Token Terminal]

> What Metrics Matter for Internet Native Money [Lightspeed]

> Nik Johnson: ENS [Epicenter]

> The Network State Conference [The Network State]

> Weekly Roundup 10/03/2023 [On The Brink]

> Arbitrum DAO approves proposal to activate token staking [The Block]

> NFTs get the Simpsons treatment in latest episode [The Block]

> Gearbox Protocol V3: The Onchain Credit Layer [Gearbox Protocol]

> Monero Hack [Mikko Ohtamaa]

> The Intents Bridge [Across Protocol]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.