Lending marketplaces

In our previous posts we have provided extensive coverage of automated market makers (AMMs), roboadvisors, lending protocols and other DeFi primitives. They all offer opportunities to generate investment returns, but where do these returns come from?

Let’s start with lending. The mechanics of interest rates is self-explanatory - demand for debt (as % of available supply) drives the interest rates.

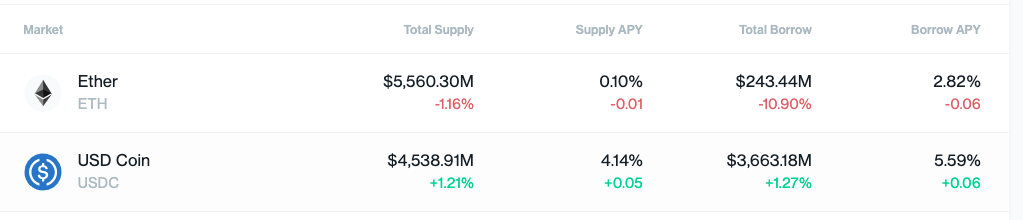

As you can see below, not that many people want to borrow ETH vs how much is deposited - hence interest rates are low; USDC debt is in more demand hence the rates are higher.

There is USD 40bn sitting on deposits across two largest DeFi platforms - Compound and Aave. As institutional capital comes into the space, these are the logical places to start - whether these are institutional investors or crypto DAO who are sitting on billions of dollars of value in their treasuries and need to deploy it somewhere.

The problem is that like everything else in crypto, interest rates are very volatile:

This makes treasury management a difficult job in crypto and is therefore a restricting factor, not allowing the space to reach its true potential. Serious treasury managers can’t comfortable borrow from these marketplaces and institutional investors can’t rely on the current yields to meet their investment targets.

AMMs

Here this is even harder. Decentralised exchanges allow us to deposit capital into market making pools and collect trading fees. Another important piece, as covered before, are the protocol rewards which are distributed to capital providers to lock in their liquidity (i.e. you receive equity in the exchange for providing liquidity to its users).

If someone would like to try and forecast what future returns from this activity would be, they are in for a challenge. They would need to try and anticipate future trading activity and the size of the pool as well as future market cap of the exchange (as they are getting tokens which fluctuate in price). In short, it’s close to impossible to model future expected returns into the future over a reasonably long period of time.

This is 3pool - the largest AMM pool on Curve (the main stablecoin exchange):

As you can see its yield went to 5% from 20% within one quarter - quite a change for those who rely on it to meet payroll!

Fixing it up

Ability to offer fixed rates is a key element required to attract more capital into DeFi and Element Finance is working on just that!

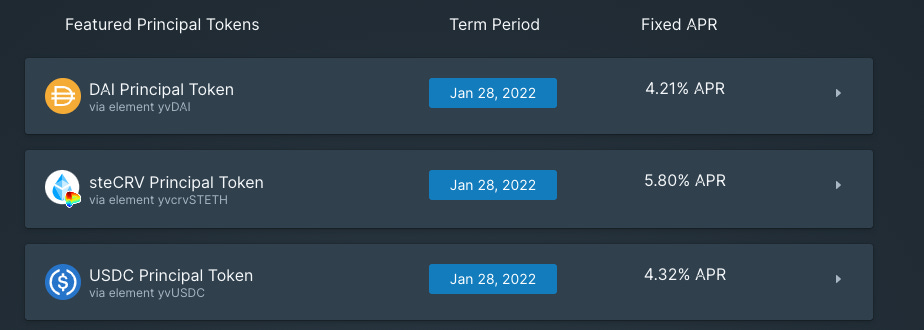

Its users can choose a term and lock in the rate:

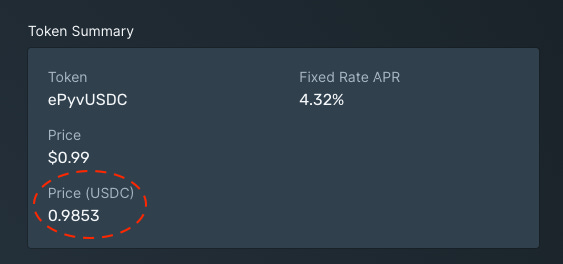

Uses can bring in their assets (stablecoins or not) and ‘mint’ Principle and Yield tokens. Principle token trades like a zero coupon bond and therefore has an embedded yield built in inside it:

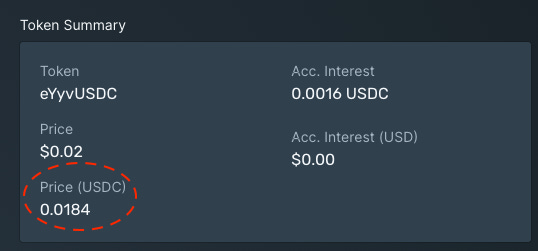

Meanwhile the Yield token is traded separately and is comparable to interest rate swaps:

Given numerous maturity terms across various assets, this could be the formation of yield curves in DeFi - a key component which serves as foundation for debt issuances, credit portfolio management and confidence to deposit capital over long periods of time.

This is a key piece of financial innovation and yet it’s only the beginning - if we can take complex AMM pools and split the variable and highly volatile revenue streams into fixed and variable parts, what other cashflows could this be applied to?

Author is the Managing Partner of Re7 Capital - a stablecoin centric DeFi fund.