Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Summary

In this edition, we cover:

How the ‘Golden Age’ of cryptoasset adoption is playing out in real-time cross-sector.

Tracking the ‘Golden Age’ of Cryptoasset Adoption

Earlier in 2024, we explored Re7’s ‘Golden Age’ thesis for crypto.

Specifically, we would witness the first adoption cycle where crypto no longer operates isolated from traditional ecosystems.

The ‘Golden Age’ here is defined as a period of coherent growth, driven by institutionalisation and convergence with Web2 and other exponential technologies.

The thesis appears to be playing out in real-time and, over the last few months, the Golden Age of crypto adoption can be seen widely across multiple sectors and verticals.

Tokenisation of TradFi Markets

Tokenised treasuries are increasingly being used as collateral.

$1.7B of treasuries are now tokenised - 3x over 1 year.

Unlike previous cycles, major players in the asset manager and investment bank arenas have launched tokenisation initiatives using public and customised blockchain networks.

BlackRock, Citi, Fidelity, Franklin Templeton, JP Morgan and others have made headways with creating blockchain-based funds.

These initiatives have seen high demand too. After launching a spot Bitcoin ETF, BlackRock’s tokenised treasury fund hit $375m within 6 weeks.

On-chain money market fund adoption even comes as interest rates run high as investors have access to a 5% virtually risk-free rate.

In other words, on-chain adoption is becoming decoupled from the broader interest rate trends.

Altcoin ETFs

Following the launch of spot BTC ETFs, which have seen $14.5B in net inflows, several issuers have filed ETF applications for altcoins - which have a total market capitalisation of $875B today and growing.

SEC Chair Gary Gensler previously stated an Ethereum ETF approval could take place “sometime throughout this summer”.

Now we see 21Shares and VanEck files for a Solana ETF. While the timing is far from clear, the signal is the direction in which we are heading.

Altcoin ETF would further cement market legitimisation and enhance how investors access cryptoassets.

Payment Processors

Payment processor networks like PayPal and Stripe are still building out their stablecoin capabilities and integrations.

PYUSD is PayPal’s stablecoin pegged to USD aimed at ‘bridging the gap between fiat and Web3 consumers, merchants, and developers’.

PYUSD is making new ATHs at $400m today.

Companies like Visa have also identified high-performance chains (e.g. Solana) can be effective stablecoin settlement networks.

What’s more? They have also identified the power of on-chain incentive programmes that can more effectively guide behaviour that drives value back to the company.

Bridging the Digital to the Physical

NFTs are no longer constrained to the digital. They are being bridged to the real world to enhance how collections interact with their audience.

Toys using the IP of NFT collections have been put in the largest retailer in the world with NFT toy popularity leading to wider store expansion.

Web3 is also enhancing the fan experiences including for some of the largest football teams in the world including Manchester United and PSG.

Football fan tokens are now a $322m market, trading >$30m/daily.

Some of these sports teams have even chosen to issue digital equity on-chain where token holders will have access to exclusive offers and experiences.

AI (LLMs)

In the words of Balaji, Crypto is digital scarcity. AI is digital abundance.

Advancements in outside technologies LLM performance and GANs are being used within Web3 which weren’t possible in previous cycles.

AI is now making transaction automation become abundant while crypto is digitizing the technology - for example through the use of AI agents.

AI agents are already revolutionising gaming and entertainment by providing personalized, dynamic and immersive experiences, far surpassing traditional user-generated content.

What makes AI x Crypto convergence exciting is the combination of one exponential technology with another (see Reed’s law).

Web3 UI Abstractions with Web2

Using crypto rails is becoming easier than ever with users now being able to use crypto products directly on Web2 UIs.

For example, last week, Solana launched Blinks which enables users to connect and send transactions without having to leave the website they are on.

Blinks work by embedding interactive elements into messages that users can click on to perform specific actions.

Blinks is another example of how we are now seeing significant developments in projects to improve user experiences and operational efficiencies in this current adoption cycle.

Closing Remarks

We are entering the most exciting phase of crypto’s technological revolution. Coming out of its ‘turning point’, businesses, developers, founders, and investors, have been coming together to define a new order.

The data points for the Golden Age of crypto adoption are all emerging in real time. Slowly at first, then all at once.

"Reality leaves a lot to the imagination. " – John Lennon

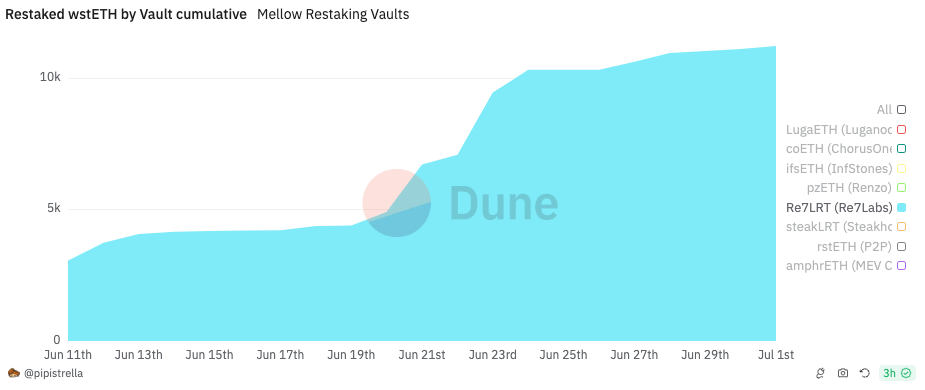

Mellow wstETH vault increase

Caps raised on Re7LRT Mellow Vault

The wstETH deposit cap has been raised on our Re7LRT Mellow Vault, allowing new depositors to come in and prepare for the upcoming raise of Symbiotic deposit caps.

We did a deep dive on Mellow and Symbioitic that was featured in Our Network.

Check out all of the data from the first week of launch there.

With boosted Mellow points until Symbiotic caps are increased, depositors in the vault can also use Re7LRT throughout DeFi including popular protocols like Pendle and PWN.

ICYMI

In a recent post on our blog, we have dived into how users can start thinking about restaking risks and rewards.

Restaking: Risk / Reward Management

TL; DR: Similar to our risk index framework for DeFi protocols, we propose a rubric for evaluating restaking opportunities to help restakers make informed decisions with a clear view of risks and return profiles. Using this risk management framework as a foundation, we are excited to announce that Re7 Labs will be launching a new vault for a liquid resta…

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.