Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid venture strategies.

Summary

In this edition, we cover:

Measuring the resurgence of on-chain stablecoin activity

Examining Solana’s recent stablecoin market dominance

Analysing the key developments driving Solana’s stablecoin growth and mapping the ecosystem

As 2024 gets underway, the cryptoasset market has steadily started the new year - holding around $1.63T in total market capitalisation.

One area Re7 has been paying increasingly close attention to in recent months is stablecoin trends.

As we noted in 2023, stablecoin supplies retracted by 40B when the US 10-year broke above 2% and started growing again by $10B when those same yields failed to break above 5% - a level perceived as the upper limit by the market necessitating a shift in market yield strategies.

Today, more capital is entering the ecosystem seeking Web3-native yield.

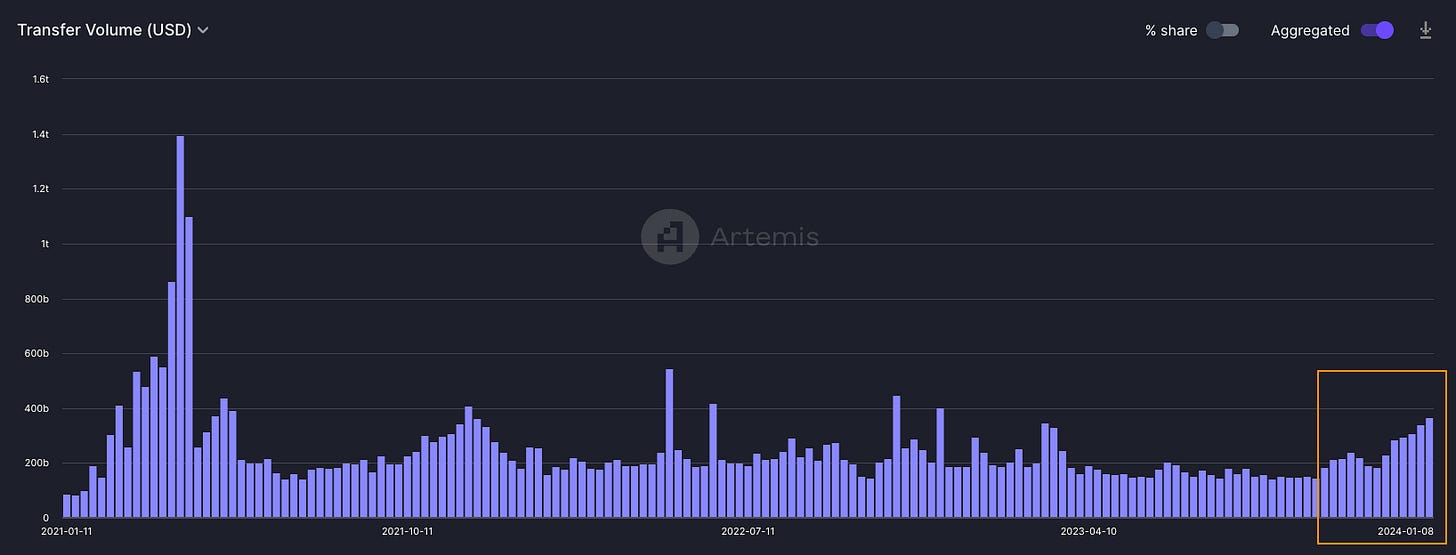

Total transfer volume has steadily increased over the last 3 months - 2.2x since October but still far below levels seen in 2021 during the last bull market.

Unlike previous periods of stablecoin expansion, how users are utilising stablecoins is different.

There are new products, partnerships, technological advancements, and regulatory approvals that dictate the direction of the constantly evolving stablecoin ecosystem.

One area Re7 sees as being growing quietly among the intense Bitcoin ETF news cycle is the Solana stablecoin ecosystem.

Since October 2023, Solana stablecoin transfer volume has increased 53x, from $2B to $107B.

In other words, Solana has been the fastest-growing stablecoin ecosystem over the last 3 months and has generated the most stablecoin volume over the past week at $120B.

The most impressive aspect here is Solana's stablecoin growth has only increased 1.3x to 1.84B. Solana has a much higher velocity for stablecoins where there is much higher volume on a per stablecoin supply basis.

A key reason for this is Solana’s relatively lower transaction fees at 0.000005 (~$0.00045) which is a necessary component for any payment network or use cases like remittances.

This likely also colours why the average transaction value is relatively low on Solana as fees never represent a high percentage of the transfer amount. The majority of transfers excluding November are for under $5. This makes Solana a suitable home for micropayment use cases.

We identified several developments over the last 6 months that appear to be working together to drive Solana’s stablecoin growth as well as development as a differentiated stablecoin ecosystem:

Regulatory oversight (December 22nd 2023) - Paxos received approval from NYFDS to expand to Solana. Paxos intends to offer USDP, a USD-backed stablecoin on Solana on January 17th 2024.

USD-stablecoin issuers (December 18th 2023) - Circle launches EURC stablecoin on Solana. Circle’s mission is to have the largest dollar stablecoin network.

Treasury-backed stablecoins (December 19th 2023) - Ondo Finance launched USDY on Solana, boosting the Solana DeFi yield ecosystem.

Settlement networks (September 2023) - Visa expands stablecoin capabilities to Solana citing low, reliable fees and fast transaction finality.

Consumer Apps (August 2023) - Shopify accepts Solana USDC via Solana Pay.

Technological Advancements (Est. launch Jan 2024) - New token standards through token extensions that provide confidential and KYC-d tokens for institutions and vendors.

Payment Management (December 2023) - Payment Manager Sphere goes live with its full-suit payment stacks to manage wires, invoices, and payment links.

Lastly, Solana’s stablecoin ecosystem is adjacent to its NFT ecosystem. For example, token extensions will allow users to pay for gated content via non-fungible tokens. It’s also conceivable that NFTs can be used for KYC-d users within a payment system or network.

Several developments on and off-chain are compounding together, putting Solana at the forefront of the stablecoin market. Looking ahead, we are excited to see the rollout of token extensions which can enable new business standards around stablecoins in 2024 and beyond.

Across Protocol - Bridge Volume

Across now facilitates over $15m in daily bridge volumes

Cumulative volume has now surpassed $4.4B

Current volumes generate ~$19k ($7m ann.)

Bonus: Across now represents >30% of non-native bridges

Global Market Cap

$1.64T; Markets remained largely flat over the last week, failing to breach above $1.8B following the approvals of spot Bitcoin ETFs in the US.

US Domestic Liquidity

BTC’s spot trend continues to be in line with trends in US domestic liquidity as expected. ISM leads liquidity by ~15 months where ISM’s over the past year decline implies further liquidity growth in 2024.

DeFi

$75B; The DeFi sector continues to edge higher after breaking its wedge in November. Resistance at ~$80B.

ETH/BTC

0.0593; ETH/BTC bounced off its 0.05 support as spot Bitcoin ETFs were approved. Briefly broke below its multi-year wedge support. Wedge resistance at ~0.067.

Liquidity

ETH/BTC bounce from 0.05 comes at a time when its 1Y rate-of-change (white) continued to diverge from US domestic liquidity growth (red) which remains positive. The two have historically matched in direction.

Bitcoin Dominance

BTC.D; Dominance failed to sustain a breach above 54% - a level we saw as a challenging area to break in December.

Trader Positioning

OI-weighted funding rates remain positive (0.018%) after falling from 0.06% when BTC hit ~$45.5k. Traders remain predominantly bullish with a complete funding rate reset not yet occurring.

From the 9th Jan 2024, futures liquidations have been net long with $112m+ being liquidated for BTC on the 12th alone.

> Manta Network [Fundamentals]

> Why Crypto Matters [Lightspeed]

> Unpacking the ETF [Empire]

> End-to-End Encrypted Ethereum L2 [Epicenter]

> Predictions: ZK in 2024 [Zero Knowledge]

> Game Over: More Than 30% of Crypto Games Have Been Discontinued [Decrypt]

> Nomura's Laser Digital unveils Polygon-powered Libre protocol for Brevan Howard funds [The Block]

> Volume 165: Digital Asset Fund Flows Weekly Report [Coinshares]

> Arweave Fork [Samcwilliams]

> ON–199: Lending Protocols [OurNetwork]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.