Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

We’re Hiring!

Investment Analyst (Liquid Token)

Re7 is searching for an Investment Analyst - someone who will be working directly with the Opportunities Fund leadership team and supporting functions including data engineers. This is an opportunity to work at web3’s innovation frontier and have a direct impact on portfolio decisions and design.

If you are insanely passionate about crypto; if you can’t imagine NOT playing with every new Web3 platform that pops up; if in the last year you spent more time in web3 than outside - then this opportunity is for you.

Apply here!

Summary

In this edition, we cover:

Relative performance between beta, higher cap and lower cap names

The two-phase bull market framework and the drivers for altcoin dominance growth

The relationship between performance vs. market cap and volume

The bidirectional and inseparable relationship between fundamentals and performance

Bull Market Phase

Let’s take stock for a second.

The crypto markets have rebounded 160% off 2022’s lows, fast approaching the $2T mark.

In what feels like just a blip, we’ve seen endogenous catalysts include strong, resilient BTC ETF inflows and divergence between crypto fundamentals vs. valuations while exogenous catalysts including lower treasury yields, a weaker dollar, the prospect of rate cuts, and higher risk premia.

The perfect ingredient list for a ‘good old fashioned reversal’ cocktail.

Those claiming a bull market now have sat on the sidelines not capitalising on the opportunity for the past year.

The good news is we are so early. All-time-levels haven’t even been reached yet.

As we’ve often highlighted, it was and always has been about the rate of change.

When the 1Y% change of the global crypto market was finally turning positive, the bottom of the bear market was put in (grey line).

The rate of change trajectory remains positive with a lot more room to grow based on previous cycles.

In a sense, this represents the broader opportunity.

Yet, the more meaningful opportunity, we think, lies at deeper layers of the market.

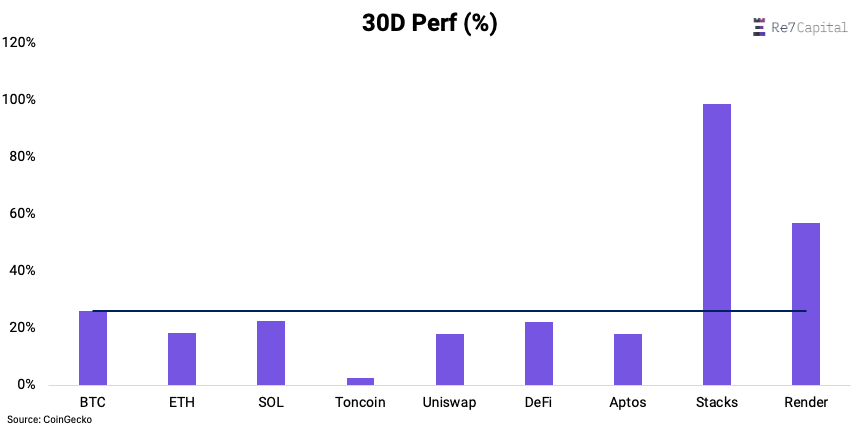

Performance over the past month has been mixed.

Spot ETF inflows to Bitcoin and its corresponding speculation has driven a tall order for alternative assets when it comes to performance over the past month.

L1s like SOL have underperformed by 3% while other higher cap names like RNDR have outperformed beta by 31%.

How to make sense of it all?

The working framework is rather simple.

Beta is currently attracting steady multibillion-dollar inflows and the pace isn’t slowing down. Capital rotation down the risk continuum to other L1s is in progress with several L1s being able to catch up with beta.

Select assets with narrative leverage like Stacks (Bitcoin) or Render (AI) are outperforming. Investors are seeking beta to a name or theme.

Buckle your seatbelt, Dorothy, 'cause Kansas is going bye-bye

When we zoom out, Bitcoin’s strong relative performance is not being met with growing Bitcoin dominance within the market.

Topping out at ~56%, the index has printed lower highs since the US ETF approvals.

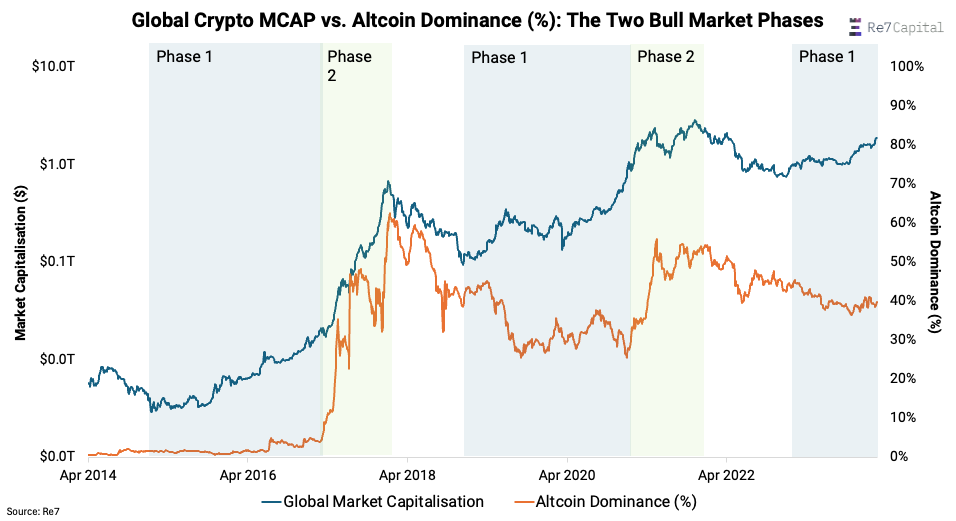

Bull markets can be carved into two phases:

Phase 1: Global crypto market rallies off its bear cycle bottom while the Altcoin dominance remains flat/declines

Phase 2: Altcoin dominance turns positive as bull market momentum strengthens

Historically, layering into liquid alpha during Phase 1 has been the opportunistic window despite beta remaining relatively strong in the market in this period.

So while BTC dominance declines, Alt dominance has started to remain resilient.

The changing of the guard seems to be looming near. Others are now sniffing out the dynamic too…

There are initial signals that capital is flowing to assets on the risk continuum which is typical of a phase 2 period but not to such a degree of significant outperformance yet.

The relationship between performance and market capitalisation rank of altcoins shows a slightly positive but insignificant relationship.

Performant assets have generally been found in the mid-cap to low-cap range.

Another lens: investors are already looking down the risk continuum in anticipation of a phase 2 bull market starting, mid-caps being the focus for now.

The other constraint that has likely muddied the water with the above chart has been liquidity.

If we swap ranked by market capitalisation to volume we see a negative relationship instead: more liquid names have relative outperformance as they represent an arena for larger investors to play in for now.

But this is a dynamic we see changing as further capital moves down the spectrum of liquidity over time.

Long-standing altcoin sectors like DeFi are starting to outperform BTC and select high-cap names MTD by 5-10% while keeping very close to ETH which is in turn now outperforming BTC.

This also aligns with the ‘changing of the guard’ framework.

Finally, the outperformance of alts has, and will, coincide with stronger inflows of capital into the Web3 products.

Stablecoin market inflows are now averaging 200-500m daily and growing. Some of these flows are going to key app verticals, including lending, DEXs, RWA platforms, and derivatives.

Fundamentals drive performance and performance drives fundamentals.

So what does this all mean?

We see high-quality assets with strong, resilient fundamentals that drive dominant mind share as the biggest opportunity heading into phase 2 of the bull market.

The market focus is currently skewed towards beta for good reason but this sentiment ‘distraction’ is for capitalising on.

Blink and you will miss it.

Re7's WETH Vault On Morpho Blue

Re7 was picked to be an initial curator for Morpho Blue, and our WETH vault launched just two weeks ago.

The vault lends ETH on Morpho Blue markets against a basket of Liquid Staking and Liquid Restaking tokens to get a yield higher than base staking rates. In a short time, the vault has seen almost $4m in deposits.

Morpho Blue is a new lending protocol that offers isolated markets and a host of new features to optimize both the borrowing and lending experience.

With the flexible architecture, we have been able to create a WETH vault that is enabling new markets for ETH staking derivatives.

Where is the yield coming from? Early market incentives are running for all new markets, with teams kicking in over $45k each to help bootstrap initial liquidity.

But there is also a more sustainable aspect as the higher yield from liquid restaking tokens can support a higher borrow rate long term. This higher rate flows directly to the vault depositors. With the eETH market seeing constant high utilization, lending rates there have risen to over 20%.

With more assets coming on to Morpho Blue shortly, we're looking forward to further exploring the growth of the WETH vault and Morpho.

Global Market Cap

$1.93T; Markets +9% last week and 3rd consecutive positive week. Approaching $2T MCAP and 35% below all-time-high levels.

Crypto vs. Equities

BTC continues outperforming NASDAQ, printing +10% on a relative basis last week. We signalled a potential wedge breakout to the upside last week which has now been confirmed. This is akin to October 2020 technically before BTC outperformed NDX by 370%.

DeFi

$90B; DeFi finally breaking out above the consolidation range of $67B-$76B. Next possible resistance is +28% at $115B.

ETH/BTC

0.05565; ETH/BTC bounced off good support of 0.05 last week (+6.4%). The path of least resistance is up, not down with investor positioning before Dancun upgrade going live in March and the combination of the 0.05 support + multi-cycle wedge support (0.051) compounding each other.

BTC ETF Inflows

$2.27B; Highest net inflow to Bitcoin ETFs on record. Pace of inflows is increasing, not decreasing. GBTC outflows are now static at -$150m daily, far less than total net inflows seen across all ETF products.

Trader Positioning

OI-weighted funding rates remain positive (0.0227%) and are ticking higher as traders take an increasingly bullish positioning.

Futures market is not overly leveraged either.

Annualized funding rates are relatively lower than their peak in the previous bull cycle. Key reason is that investors can now trade spot (via ETFs) more easily.

Liquidation analysis shows shorts are still being caught with $50m+ daily short squeezes occluding.

> How Pyth Propogates Financial Data [Lightspeed]

> Chain Abstraction [Bell Curve]

> How AI is generating and digitizing documentation across financial services [The Fintech Blueprint]

> Crypto Derivatives and Structured Products [Epincenter]

> Farcaster Insights [Unchained]

> L1 User Growth [Jamie Coutts CMT]

> Y Combinator, Startup Incubator Behind Airbnb, Coinbase, and Stripe, Looks to Invest in Stablecoin Finance [Coindesk]

> ON-206 RWA [Our Network]

> Pudgy Penguins briefly flips Bored Ape Yacht Club in floor price [The Block]

> Artemis Weekly Roundup 16th Feb [Artemis]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.