Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Group

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies. Re7 Labs, its innovation arm, which specialises in on-chain risk curation, vault management and DeFi ecosystem design.

> Re7 Capital on X

> Real-time Insights from Re7 Labs

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies. Re7 has the following open roles:

Investment Analyst(Liquid Token)

We want to hear from you!

Summary

In this edition, we cover:

Market update

NFT market dynamics

A revisit to asset lag theory

Crypto markets gain another +4.5% on the week, making new ATHs.

The crypto market is eyeing a new monthly closing high relative to the NASDAQ and it continues to outperform this cycle and from a secular trend perspective.

The strength in the market now is in alts where alts have outperformed BTC by 14% MTD.

Altcoin market capitalisation correlation to BTC continues to weaken as a signal of investors rotating from beta down the risk continuum.

NFTs and Asset Lag Theory

In December 2023, we wrote about our asset lag theory based on the wealth effect: behavioural economic theory that consumers spend more when their wealth increases even if their income does not.

Investors making profits during a constructive market can move into more speculative assets down the risk continuum (i.e. recycling gains) while also selling out of these more speculative assets to achieve liquidity during more distressed periods.

The most speculative assets, like NFTs, lag by 15-18 months in their peak and troughs as this capital shift happens more gradually.

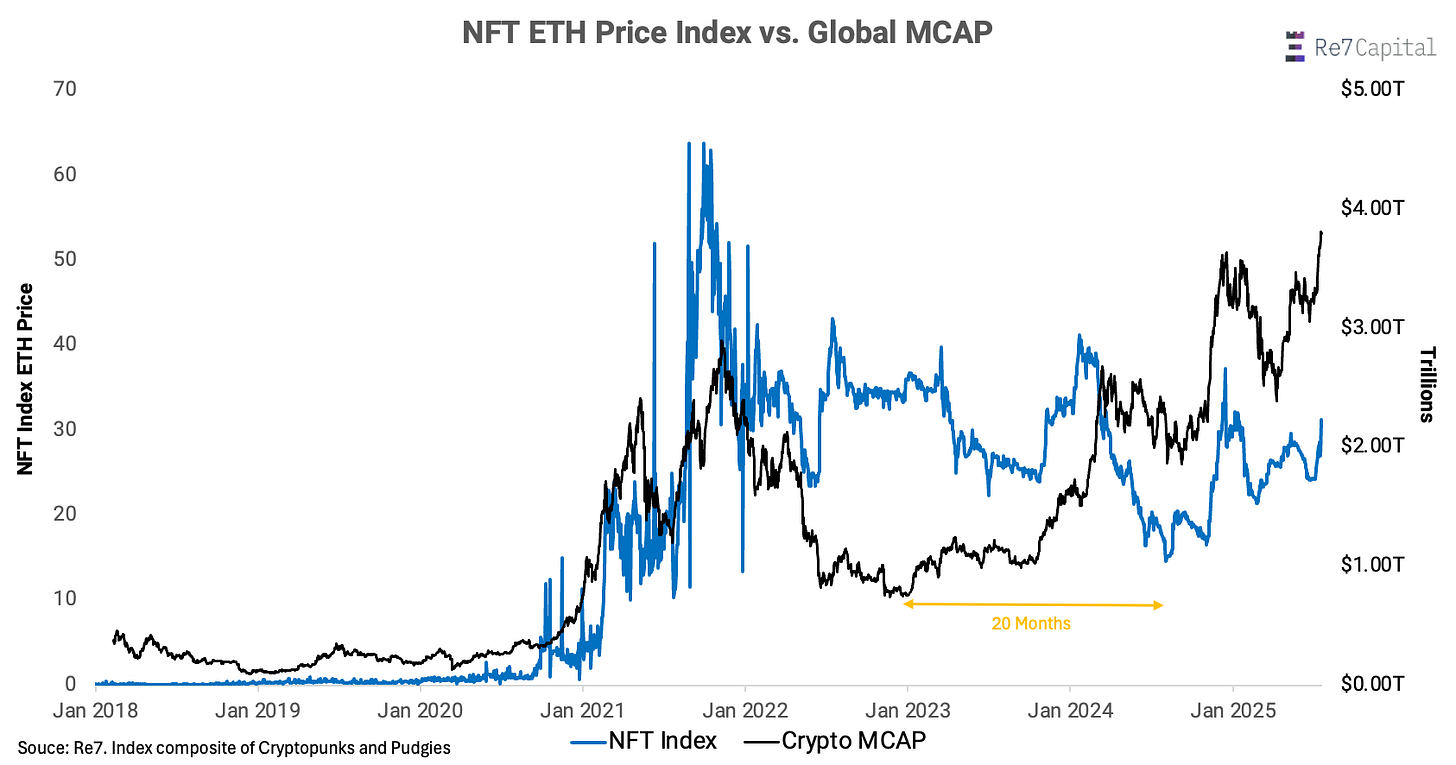

After ~20 months since the market bottom, we see evidence of NFTs priced in their native asset (ETH) putting in their floor. For example, taking a price composite of CryptoPunks and Pudgies (below).

The reason for the slightly extended time frame this time round? The Fed and many central banks globally performed the largest financial tightening programs on record by absolute value post COVID.

As global market capitalisation of digital assets rises to new ATHs, we now see NFT collections as trophy assets get rotation capital from other assets.

Floors of a number of NFT collections like Crypto Punks, Pudgies, and others swept from unknown entities over the weekend.

We can get a signal of this by measuring their ETH-denominated price to adjust out of USD volatility.

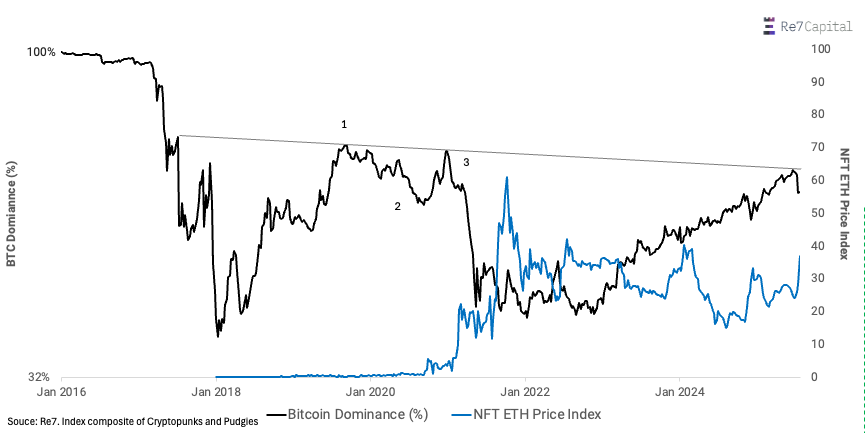

Another way of looking at this wealth effect dynamic is through Bitcoin dominance. As dominance declines, investors move further down the risk continuum by allocating to alts.

When Bitcoin dominance topped out in 2019 pre-COVID (1), NFT prices started to gain for several month (2). It was only until confirmation of a BTC dominance top (3) where NFTs price gains really accelerated.

Today, we see price the highest NFT price rallies since August 2024 strongest as BTC dominance also looks to top out this cycle. Markets of rhyme.

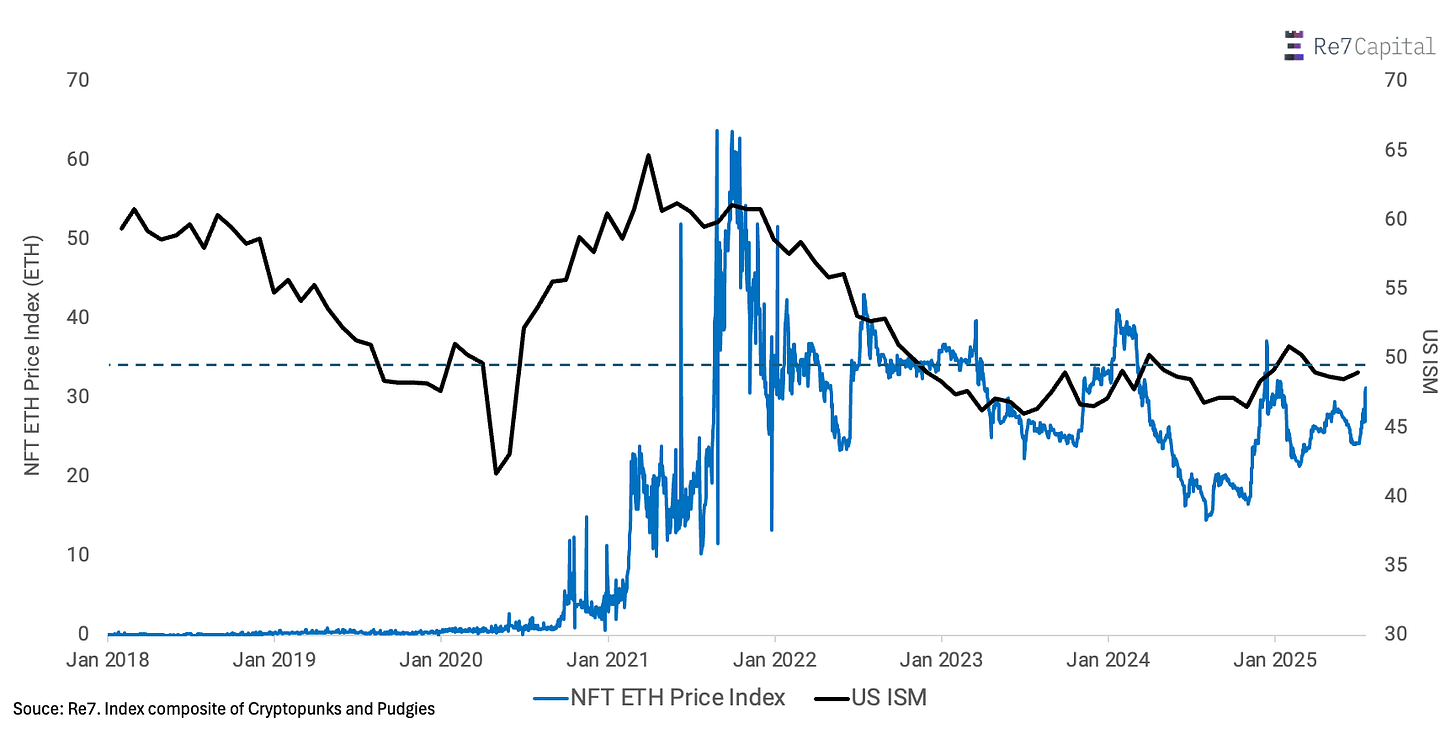

And because asset prices are all driven by the business cycle, we see NFT prices moving in line with economic growth measures like the US ISM.

More growth, higher income, credit expansion, sentiment, spending, and wealth.

The US ISM moving into expansion territory (i.e. >50) is historically corresponded with rising NFT prices, driven by liquidity growth.

So with all the recent NFTs buying in select collections, it feels history is rhyming yet again.

Re7 in Media:

Trump’s World Liberty joins forces with Re7 — featured by Bloomberg.

Re7 Labs and World Liberty have launched the USD1 vault on Euler, bringing a $2B+ Treasury-backed stablecoin to DeFi with institutional-grade risk and cross-chain utility. A new standard for stable, transparent on-chain capital. Additionally, covered by Coindesk & Cointelegraph.

VMS Group Enters Crypto, choosing Re7 Capital as Partner

Hong Kong’s VMS Group (~$4B AUM) has made its first allocation to digital assets, selecting Re7 Capital’s market-neutral DeFi strategies. The move reflects growing institutional demand for yield with risk-managed access to DeFi - covered by Bloomberg.

Updates on Re7 Lab Vaults

We are excited to announce that our Euler and Morpho vaults are live on TAC!

Don't miss out on the opportunities on Euler

Supply USDT, WETH, TON, and more to the Re7 Labs cluster and earn additional incentives in WTAC and rEUL

Our Morpho Vaults have incredible opportunities as well:

Supply USDT, WETH, TON, and more and earn additional WTAC incentives

TAC is a purpose-built blockchain for EVM dApps to access TON and Telegram Ecosystem’s

We are excited to share that a fresh batch of incentives are live on AVAX for the Re7 Labs Cluster

Supply USDC, USDT, AUSD and more and earn up to 13% APY with the new WAVAX rewards

We are excited to share that incentives are flowing to our Morpho Vaults on Lisk.

Supply LSK, USDT0, WETH, and more and earn up to 20% APY in added LSK incentives.

Keep an eye out for our Gearbox Re7 WETH pool on Lisk this should be live very soon with an official announcement.

Make sure to join Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.