Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

We’re Hiring!

Re7 is searching for an Investment Analyst and a DeFi Research Analyst!

If you are insanely passionate about crypto; if you can’t imagine NOT playing with every new Web3 platform that pops up; if in the last year you spent more time in web3 than outside - then we want to hear from you!

Apply here!

Summary

In this edition, we cover:

How and why beta continues driving the market

Why retail has yet to show up

What crypto’s ‘Golden Age’ means and the specific drivers of the defined period

Data points showing this transition occurring in real-time

Temperature Check

Crypto markets are running up. Global market capitalisation has hit $2 trillion, gaining 154% from the November 2022 bottom.

Yet, we still have room to grow - even to the previous all-time-high which is +50% from today.

Cycle price discovery occurs after breaching the ATHs, not before.

Note that key structural tailwinds YTD have all been beta-related. For Bitcoin, It’s been the US spot Bitcoin ETF launches and the Bitcoin halving event (est. 16th April 2024).

For Ethereum (more recently), it’s been the Cancun upgrade and the prospect of a US spot ETH ETF launch in May 2024.

It’s keeping BTC (orange) and ETH (white) relevant, moving in line with higher/mid-cap names for now.

The dynamic is also indicative of a phase 1 bull market where higher-cap names lead smaller-cap names for a temporary period of time.

So who are behind the recent moves?

JP Morgan indicated retail traders were behind price volatility in Feb.

But the data isn’t so clear.

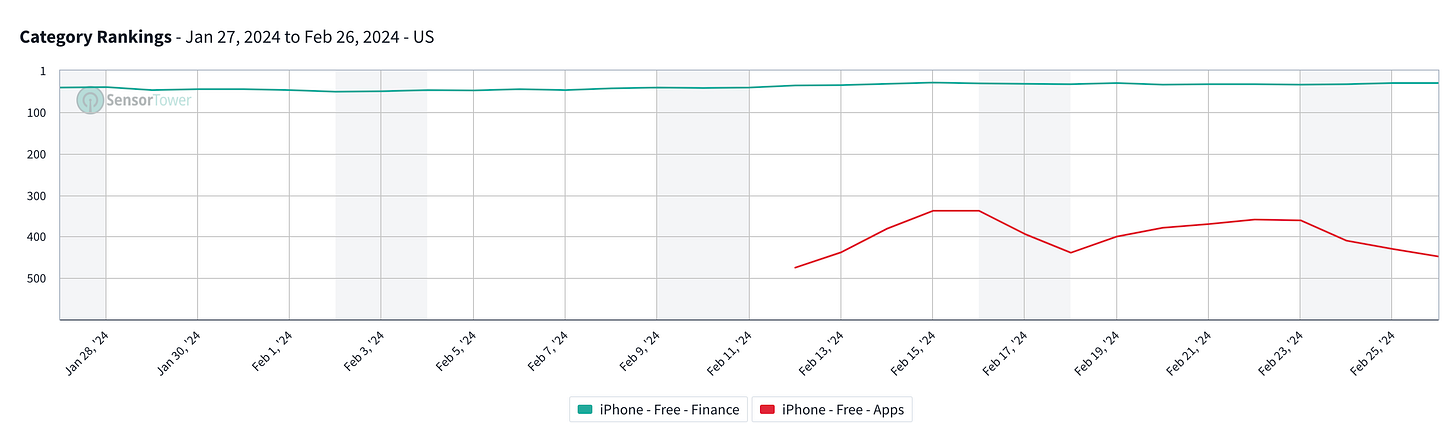

Coinbase app ranking for free apps has been falling (#450 today) and not increasing as the market picks up.

In 2021, Coinbase was ranked #1 across the entire App Store.

In the futures market, funding rates show relatively low leverage compared to the peaks of the previous cycle. Funding rates have also declined as BTC makes new 2024 highs.

Overall, the market feels measured.

As we know, one structural change vs. the past cycle is the US spot Bitcoin ETFs which have driven >$5.5B of net new inflows since inception - and inflow rates that don’t appear to be slowing down.

Past the Turning Point: Into the Golden Age

Yet, ETFs represent just one structural growth driver for crypto. Countless others are brewing under the surface and overlooked.

All the while retail hasn’t shown up yet.

It feels like the first adoption cycle where crypto is no longer operating in isolation from traditional ecosystems.

At Re7, we see crypto as undergoing a transition into a “Golden Age” of its technological revolution - a period of coherent growth, driven by institutionalisation and Web2 convergence.

So how has this thesis been shaping out in 2024 so far?

We see evidence of Web3 <> Web2 convergence strengthening across 4 lenses:

Bridging the physical to the digital

In September 2023, NFT brand Pedgby Penguins debuted its physical collection in Walmart.

Last week, the company announced it sold $10m of toys (750k) with Walmart expanding its store support by a further 50% due to its success. Each buyer unlocks NFTs with their toy that can be used within their ecosystem.

Leveraging outside yield within DeFi

The total value of tokenised treasuries has reached $700m with an increasingly diverse set of platforms offering products for users over the past year.

Outside capital leveraging on-chain benefits/yield

Stablecoin supplies have increased $15B since October and and growing at a rate of $45B annualised.

At pace, we will see new stablecoin supply ATHs by September 2024, growing a further $25B over 7 months. A portion of these stables will be put to work in a growing number of yield opportunities within DeFi.

Web2 companies using public blockchain networks/on-chain rails to enhance existing processes

Global financial tech firms like PayPal are still building out their stablecoin capabilities.

PYUSD is a stablecoin pegged to USD and issued by PayPal to ‘bridge the gap between fiat and Web3 consumers, merchants, and developers’.

Since launching in August 2023, PayPal’s stablecoin has grown to $300m (just 0.24% of total stablecoin supply).

On top of this, Visa announced it would allow users to directly withdraw crypto to their cards in over 145 countries.

Both Visa and Mastercard, which have a combined market share of 70%, are quickly embracing blockchain technology for fast cross-border payments and rewards.

Closing Remarks

We are entering the most exciting phase of crypto’s technological revolution. Coming out of its ‘turning point’, developers, founders, investors, and lawyers have been coming together to define a new order.

Now we are expanding the benefits of the new paradigm across all segments of society - the ‘golden age’. The data points are all emerging in real time.

Looker closer - you may see the larger picture come together.

But blink…and you may just miss it.

Uniswap Fee Switch

Uniswap Foundation has floated a proposal to distribute earnings from the Uniswap fee switch to UNI stakers and delegates.

On the back of this news, the token gained +40%. Additional speculation has kicked off because of this signal from one of the largest protocols in DeFi.

Will we see other projects follow their lead? Likely yes. The FRAX team has already moved forward with a proposal to distribute some revenue to veFXS stakers.

Projects with high fee capture like Synthetix have also seen positive price action based on the news.

Is this DeFi's profitability moment? Several large protocols are now profitable and as a result, considering various avenues to distribute profits back to their token holders.

As such the UNI fee switch could continue the push towards turning "valueless governance tokens" into value accrual mechanisms.

All of this offers interesting opportunities for these tokens to become productive assets with underlying yield.

ETH/BTC

0.0597; ETH/BTC cross upside breakout, breaking the multi-year downtrend. Comes at a time of increased ETH ETF speculation, increased re-staking development, Dencun upgrade, and later phases of the bull market are progressing. As we stated last week, the path of least resistance is up, not down.

DeFi

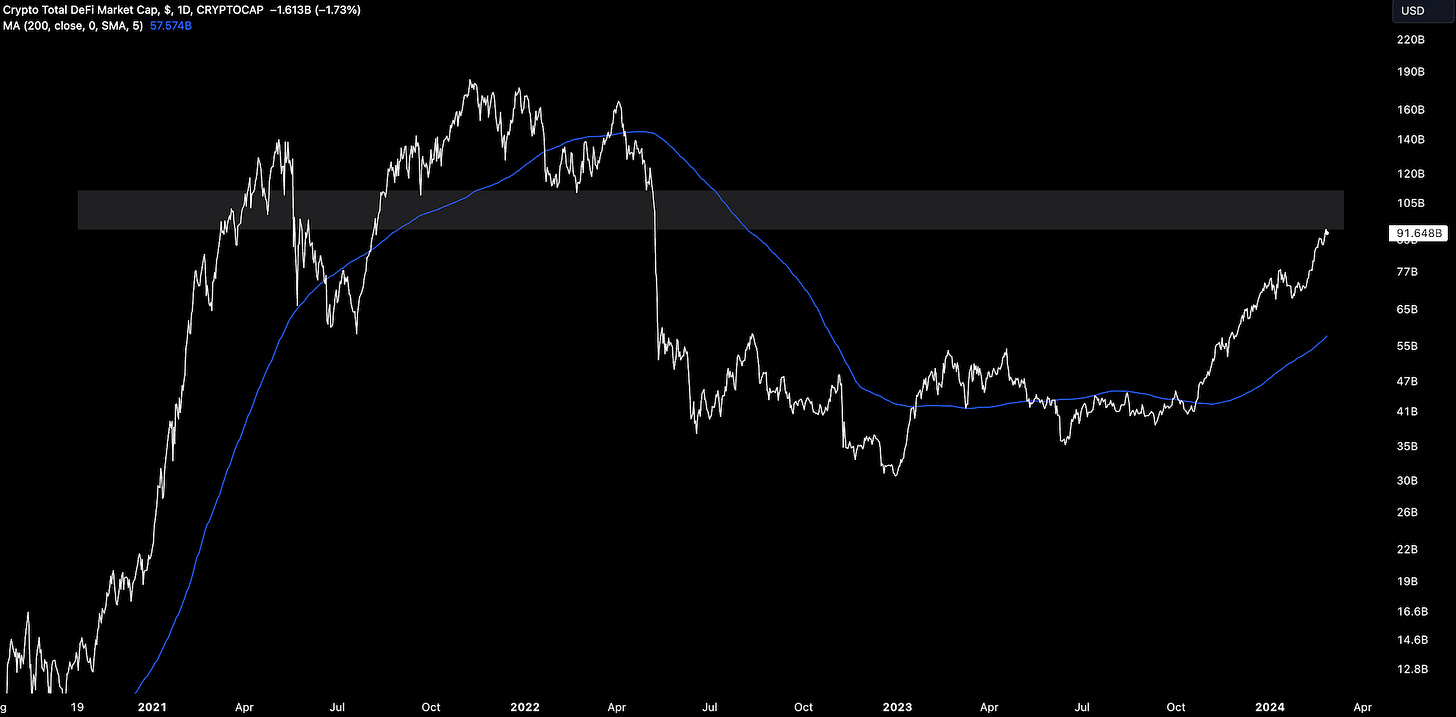

$91.64B; DeFi +24% YTD and entering an air pocket with possibly little resistance until a further +10-20%.

Perpetual Futures

$40B; Weekly perpetual volumes have surged 2x over the past month due to several incentive programs launched across platforms. DEX/CEX volume ratio is still <1% illustrating how much room there is for relative growth for the DEX offerings.

DEXs

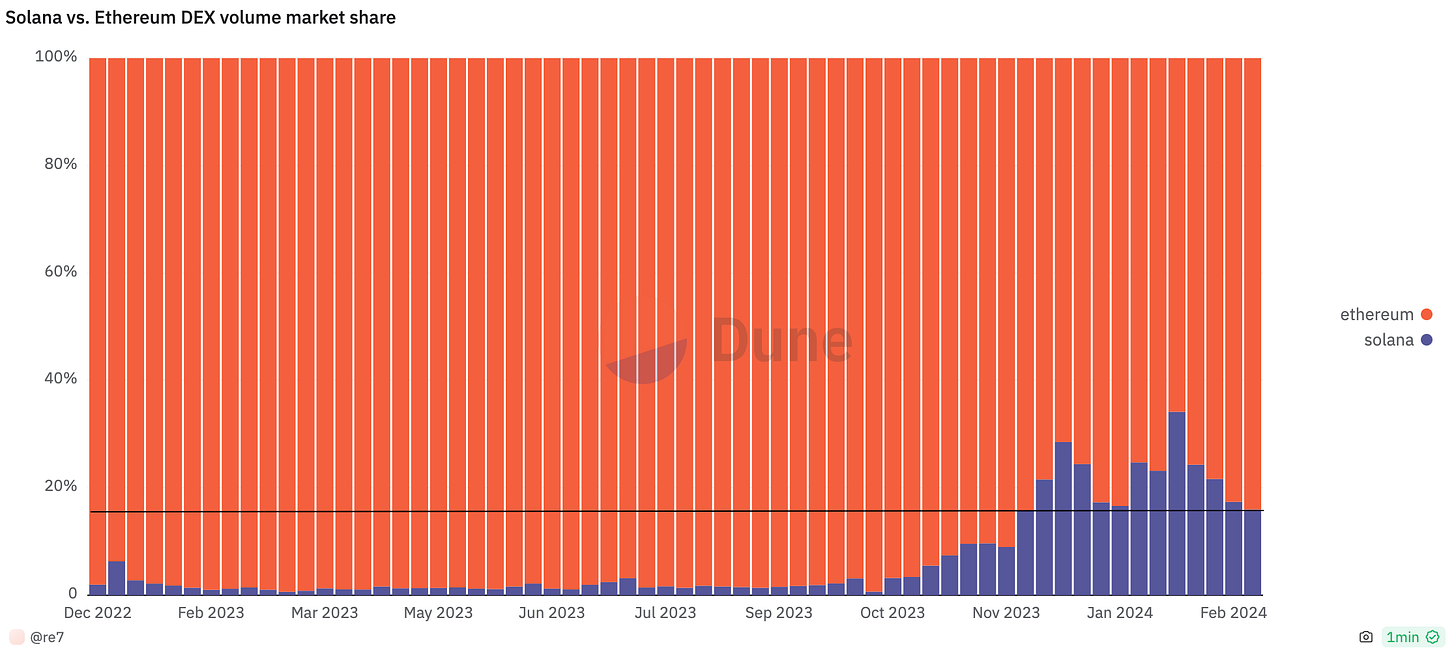

Solana/ETH DEX volume ratio has fallen from its peak of 34% to 16% in what visually appears to be a potential bottoming-out level for the ecosystem. Solana generates >$4.5B in weekly DEX volume, a 2x over 3 months.

This Week: Re7’s Latest Contribution to OurNetwork

> The Art of Strategy [Intelligence Matters]

> Layerzero - Diving into V2 [Fundamentals]

> zkp2p [Zero Knowledge]

> Why Bitcoin is Exciting [Unchained]

> Weekly Roundup [On The Brink]

> Bitcoin price ATHs [Mike Alfred]

> Benefits of Ethereum’s EIP-4844 [Sassal0x]

> Reddit adds crypto to balance sheet [Coindesk]

> Apps moving down the stack [Carvas]

> DeFi Startup Euler Finance Bounces Back with Revamped Lending Vaults [Coindesk]

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.