Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

This week at Re7:

Evgeny Gokhberg, Managing Partner at Re7 Capital, has been featured alongside top CIOs and fund leaders in CIG’s Q2 2025 Hedge Fund Outlook.

Re7 is heading to Token2049 in Dubai. We're open to conversations with partners, allocators, and ecosystem builders.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies. Re7 has the following open roles:

We want to hear from you!

Summary

In this edition, we cover:

10 trends in the digital asset market at all-time-highs

Records

This week, we’re doing things different.

In this edition of the Weekly, we highlight 10 trends at record highs across a number of themes and sectors.

One observation in collating these records, is the number of records relating to institutional adoption of digital assets and Web3 technology.

We see these trends as inevitable outcomes as the industry goes through its ‘Golden Age’ of adoption.

Anyone from businesses, founders, economists, and AI developers, are all waking to the idea that Web3 technology provides a structurally sound framework for transacting value through tokenisation.

Stablecoin USD Supply

Total USD-stablecoin supply is at $235b - growing at a rate of $10B per month at current pace.

It signals strengthening market liquidity, institutional and retail stablecoin adoption, as well as DeFi.

Stablecoin Weekly Active Addresses

The number of active addresses transacting stablecoins is ATH of ~33m daily. Growing number of users transacting a growing supply of stables.

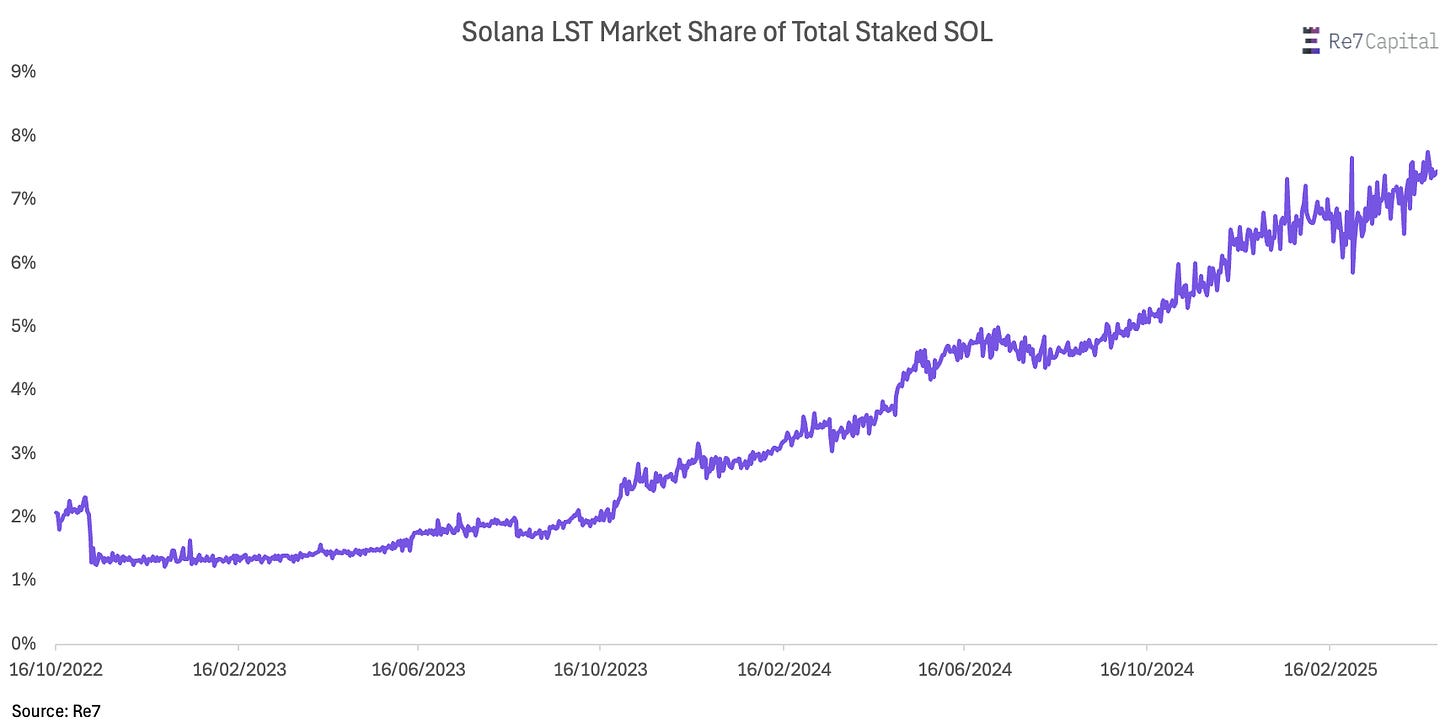

Solana LSTs (SOL)

The total market share of Solana LSTs of total staked SOL is at ATH of 7% and growing steadily.

Arguably, a natural endstate is for LSTs to become a core DeFi collateral assets within DeFi. This is because LSTs can provide yield from staking rewards while maintaining liquidity for use in other activities.

Polymarket

The number of new Polymarket markets is at ATH at 7k/month.

A growing of markets are being created where anyone can trade outcomes across virtually any domain - including politics, news, culture & tech.

DEX Derivatives Quarterly Total Volume

Derivative volume on DEXs reached $800b for the first time in Q1 2025, up +33% QoQ.

DEX/CEX Derivative Volume Ratio

DEX volume growth has outpaced growth on the centralised exchange side with DEX/CEX volume for derivatives at 7% - an ATH.

RWA Value

Total RWA value on-chain continues to surge to new ATHs, recently surpassing $20b. Value is not driven by a single sub sector but a wide range of them which we highlight below.

Private Credit

Private credit - a component a RWA on-chain is at ATH - $13.5b. Credit protocols facilitate loan originations, deal funding and borrower repayments.

US Treasuries

Tokenised US treasuries, another component of RWA value, is also at ATH, recently surpassing $6b.

BlackRock’s BUIDL fund leads in total value at $2.5B.

DEPIN Fees

DEPIN (decentralised physical infrastructure) quarterly total fees is at ATH for select number of projects, recently surpassing $2.5m.

We are now seeing institutional adoption underpinning this growth across a number of verticals, including wireless and mapping.

Updates on Re7 Lab Vaults

The Euler vaults curated by Re7 on Avalanche have reached ~$150m TVL, with USDC and savUSD still distributing ~15% supply APY.

There is currently 25%+ APY in AVAX incentives on Re7 esavUSD/eAUSD/eUSDC Balancer LP pool. Incentives are also flowing on our Euler BNB cluster with USDT and lisUSD supply APYs still above ~13%.

We added fxSAVE, the tokenized stability vault on f(x) protocol, as collateral on f(x) Protocol Re7 USDC Morpho vault on mainnet.

fxSAVE has an ~8% intrinsic APR and fx is incentivizing USDC supply to the vault, currently at ~10%.

We introduced the first isolated restaking market for blue-chip LSTs on Gearbox, using rstETH, a modular restaked ETH token curated by Re7 on Mellow, and backed by P2P.

Users can loop with rstETH to maximize restaking rewards and stay liquid while staking.

Make sure to join Re7 Labs Alpha Telegram channel for more DeFi vault announcements this week!

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.