Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Re7 is Hiring!

Re7 utilises our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of DeFi and alpha strategies.

We also work with leading projects and blockchains to design their DeFi ecosystem and provide on-chain risk curation and vault management services through Re7 Labs.

We are looking for a talented DeFi Business Development person to support the Re7 Group, scale its vaults, establish partnerships and source crypto clients who could benefit from Re7’s product suite.

Summary

In this edition, we cover:

Crypto markets ahead of the US election day

The growing MEV market opportunity

Why markets like MEV are not born equally across ecosystems

Swing States, Swing Trades

The Rumble in the Jungle is about to begin.

Since our last Weekly issue, BTC has already eyed a fresh new break out to new ATHs.

Investors around the world brace themselves for the US election results this week.

The election is a coin toss. The impact on markets in the short term is far from clear. Polling data is neck and neck and within the margin of error. The most likely scenario is that there will be drama.

On balance, a Republican win has been taken as a relatively more favourable outcome with refreshing banking regulations, supporting the bitcoin mining industry domestically, and updating SEC frameworks as examples of direct support.

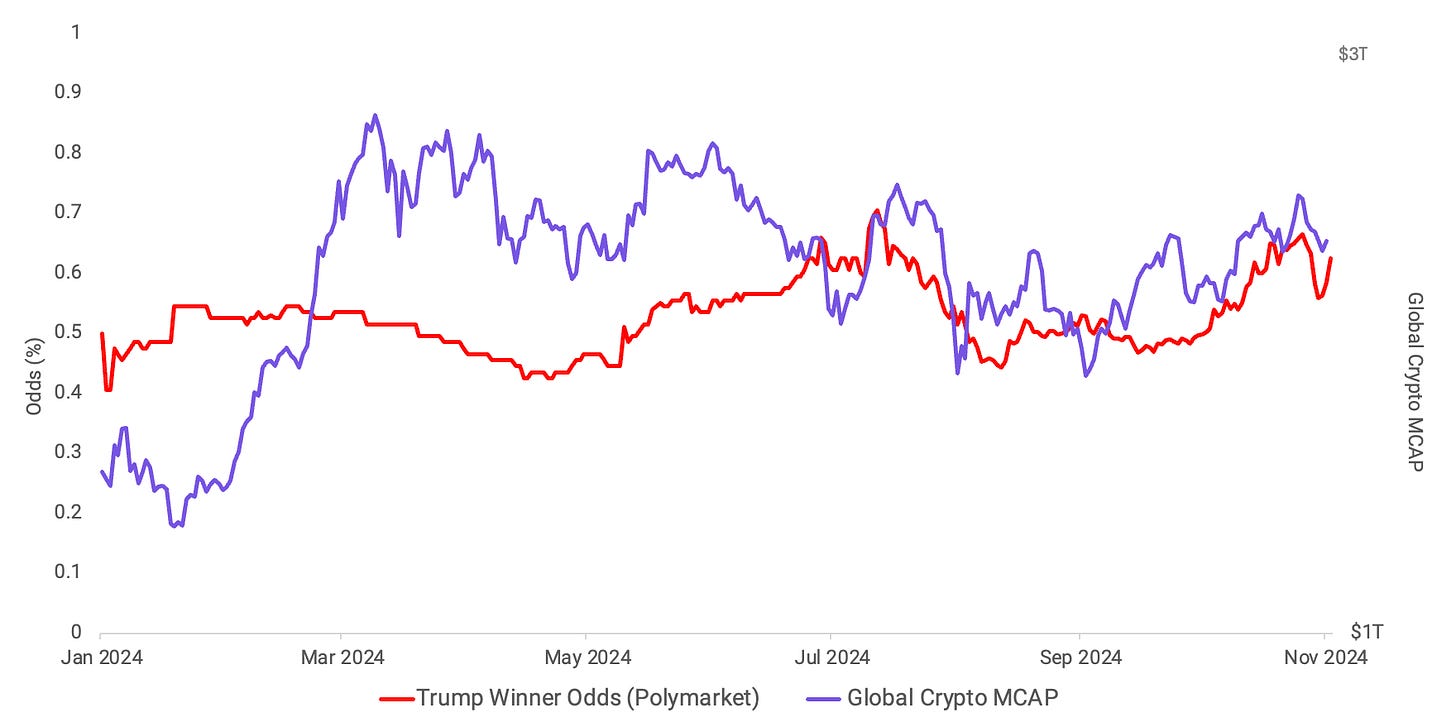

This perception has meant the chances of Trump winning have somewhat driven market valuation, particularly closer to the election.

The Longer-Term Path Ahead

Yet, regardless of who takes the seat, the longer-term macro factors at play remain the same. Liquidity, inflation, and risk premia dynamic changes remain favourable to risk assets.

For all the past cycles, the halving marked the midpoint of the respective cycle. With 527 days since the bottom to the most recent halving and 170 days since the halving to today, the lens implies over 320 days to go

Whether blue or red, we are moving from macro spring to macro summer.

MEV

MEV, or Maximal Extractable Value, is the profit miners or validators can earn by reordering, including, or excluding transactions within a block on a blockchain.

MEV enhances market efficiency by reducing price discrepancies, allowing a market to form around on-chain market inefficiencies.

On Ethereum L1, MEV revenue has stayed relatively flat in native terms. MEV revenue also represents ~10% of gas fees.

MEV (Maximal Extractable Value) tends to be higher on more performant L1s like Solana compared to Ethereum due to differences in network design, transaction throughput, and validator structure.

For example, Solana's high-speed architecture allows for a much greater volume of transactions per second than Ethereum.

This high throughput creates more opportunities for MEV because more transactions can be processed quickly, allowing bots to exploit price discrepancies across multiple transactions in a short timeframe.

Solana’s architecture allows for parallel transaction processing, meaning many transactions are executed simultaneously rather than sequentially as on Ethereum.

This structure can allow for more complex MEV opportunities to be exploited faster, increasing the volume of profitable MEV opportunities.

Unlike Ethereum, Solana MEV revenue is higher as a % of total gas fees. MEV makes up 100%-120% of gas fees.

The number of tippers, Solana users who want to prioritise their transactions by paying validators to gain an advantage, is climbing to new ATHs.

Overall, Solana’s higher throughput, lower fees, and validator design all support higher MEV potential compared to Ethereum. This also directly informs the potential size of the MEV market on Solana vs. Ethereum longer-term.

The other signal is that use cases and markets may not be born equal when applied across different ecosystems.

New stablecoin yield options with Euler and launch of rEUL

Euler launched a new rewards mechanism rEUL that gives users vesting tokens as yield that they can claim at any time. The catch is that any un-vested EUL is burned from the total supply.

rEUL and PYTH rewards will be live today for the sUSDe deposits for our curated stablecoin maxi vault on Euler. Deposit sUSDe here to earn.

Pendle fixed yield tokens are also added as collateral on Euler. Users can use PT-sUSDe with a March expiry as collateral and borrow sUSDe to play the spread between the fixed and variable rates.

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.