Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Re7 is Hiring!

Our DeFi Labs team who are one of the highest respected curators of lending and borrowing vaults, and due to the fast-growing nature of the business we need an analyst to provide much-needed support.

If you are insanely passionate about crypto, enjoy working in the middle of one of the fastest-moving industries and want to be on the cutting edge of liquid staking - then this opportunity is for you.

Summary

In this edition, we cover:

Market recovery signals leading into seasonality

Solana DEX market share resurgence

Paypal’s PYUSD

Upside Momentum

As we wrote in our previous Weekly, the market was signalling that investors were returning to the punch bowl of risk-seeking behaviour.

Fast forward to today, BTC looks to break its key $64k level heading into a month that averages +23% since 2013.

When we zoom out, assets are simply looking to complete their consolidation and bounce off the broader bull structure.

Divergences

As we’ve written extensively before, fundamentals have positively diverged to their most extreme degree to valuations - a dynamic that is unlikely to sustain.

In Singapore last week, the Re7 team were reminded about the rate of development and underlying adoption across several verticals:

Enhancing core blockchain infrastructure enabling orders of magnitude more scalability

Modularity on Solana and utilising network extensions

Vertical integrations from core DeFi protocols

With the continued adoption of crypto driving daily active wallets to new all-time highs, we see valuations converging with fundamentals - not the other way round.

The Opportunity in Alts

The most interesting moves over the last 2 weeks have been alts.

Alts typically sniff out regime changes before any other part of the market. They’re currently signalling that investors are returning to the long-tail list after consolidating since March.

This comes as central banks are aggressively cutting rates while others are unleashing extensive amounts of liquidity into the market to revive their respective economies.

Alts are also breaking out against the previous market leader, SOL. SOL dominance momentum has waned with Breakpoint marking the peak in a historically classic fashion.

In June, we also highlighted the increased likelihood of alts bottoming and outperforming beta.

When the % of alts outperforming beta over 90 days reached <10, this has often coincided with local bottoms in the altcoin market dominance.

Market Highlight Corner

Our internal market intelligence tooling is showing Solana is making a comeback in terms of on-chain activity.

Solana DEX volume dominance has surged from 30% to 45% with Breakpoint likely acting as a catalyst. All eyes are on whether Solana can sustain these levels as the conference concludes.

At the same time, we’re also noticing sustained momentum in other corners of Solana, including stablecoins.

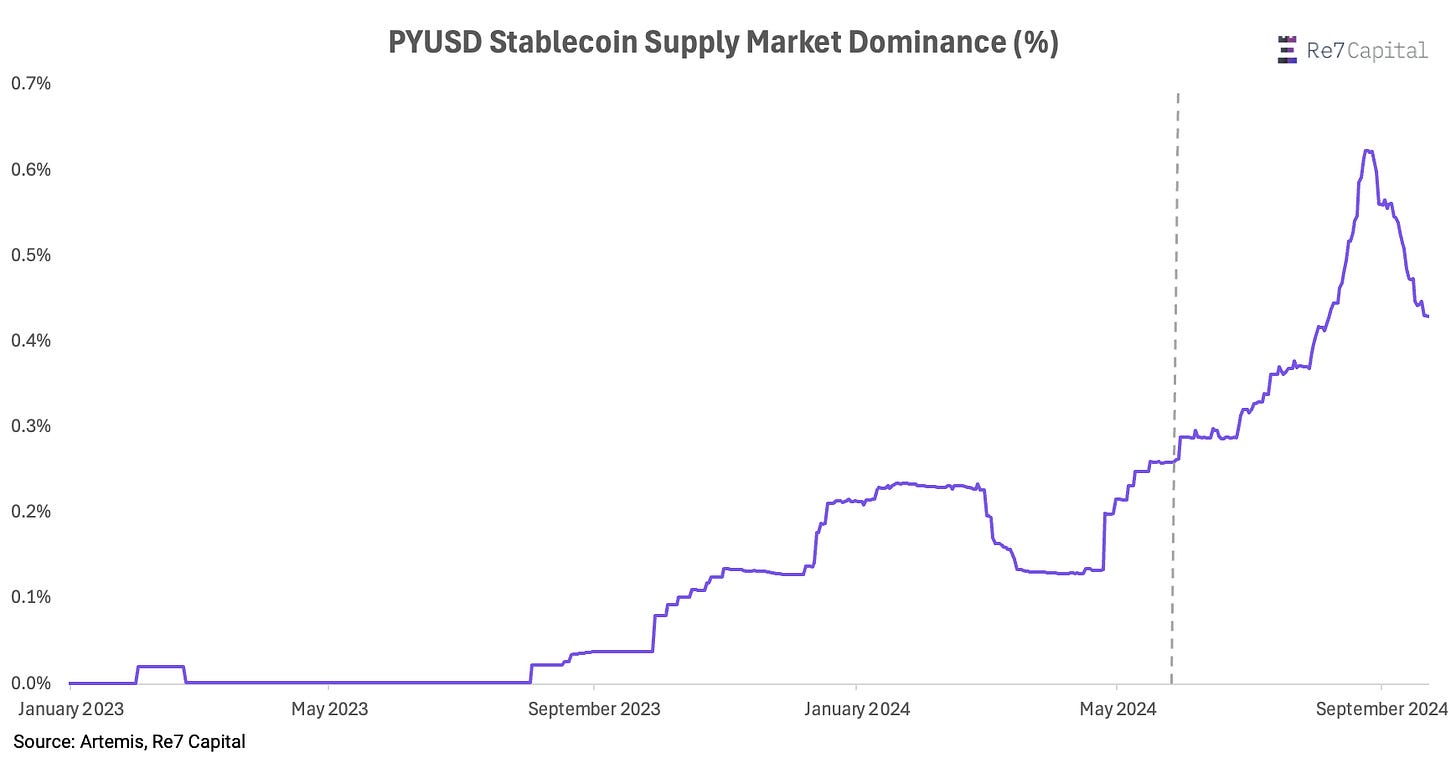

International payment system, Paypal, launched its stablecoin on Solana in late May 2024.

PYUSD now commands 0.5% of the total stablecoin supply on-chain.

More interestingly, the Solana integration (dashed line) drove 2x supply market share in 3 months.

PYUSD stablecoin transfer volume shows a more stark contrast before Solana support.

PYUSD was responsible for 1.2% of all stablecoin transfers on-chain by late August.

Since the integration, anywhere from ~40-80% of all PYUSD transfers have been on Solana.

Not only is this another signal of institutions underpinning the next adoption cycle but also that this adoption can be catalysed by more performant blockchain rails - something institutions are becoming increasingly aware of.

Morpho Blue Pyth Rewards

Borrow rewards are live on various markets secured by PythNetwork oracles on Morpho Blue

Users can borrow USDC or ETH with Renzo’s $ezETH and Etherfi’s $weWTH to earn $PYTH

ICYMI - Re7 Stablecoin Maxi Vaults

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.