Stay informed about what matters in crypto. Forget the noise. Get free market-leading crypto research by subscribing to Re7 Capital’s research below:

About Re7 Capital

Re7 Capital is a research-driven digital asset investment firm specialising in DeFi yield and liquid alpha strategies.

Announcement! NEW Re7 Alpha Telegram Group

We're starting invitations to a new Re7 Alpha Telegram group. This will be an anonymous group with regular updates on the best DeFi yields, Re7 Labs updates and first information about cap increases or other opportunities in our vaults.

Here's what you can expect:

Stay Updated: Get the latest news, announcements, and updates on our vaults and the DeFi ecosystem.

Access Exclusive Insights: Gain early access to new vault launches, exclusive offers, and insights from our team.

Our Goals:

Sustainable Growth: We want to showcase our priorities long-term growth and sustainable yields.

Community & Partnerships: We're actively seeking to engage across the space and explore strategic partnerships to offer innovative solutions.

Re7 is Hiring!

Re7 Capital is a London-based cryptoasset investment firm. Re7 utilizes our deep crypto network and proprietary data infrastructure to drive investment decisions for a number of fund strategies.

Re7 is searching for a DeFi Developer to support the Re7 tech team, developing and maintaining key backend infrastructure for Re7 products and funds.

Summary

In this edition, we cover:

Where we are the market and the current state of investor sentiment

Exploring market direction from first principles

Impact of token creation in alpha generation

Diagnosing The Market Sentiment

Another week, another period of fast developments. Global market capitalisation stands flat at $3T while BTC remains above the $95k mark. We are at the bottom of a consolidation range for the market while investors remain skittish, digesting an onslaught of geopolitical affairs, executive orders, and economic data.

Other large cap like SOL are at the bottom of their current consolidation range, replicating the type of range pattern seen in 2024.

Fear continues to permeate among investor circles. Even in consolidation phases, bottoms are formed during times of fear, not greed. Investors don’t like uncertainty.

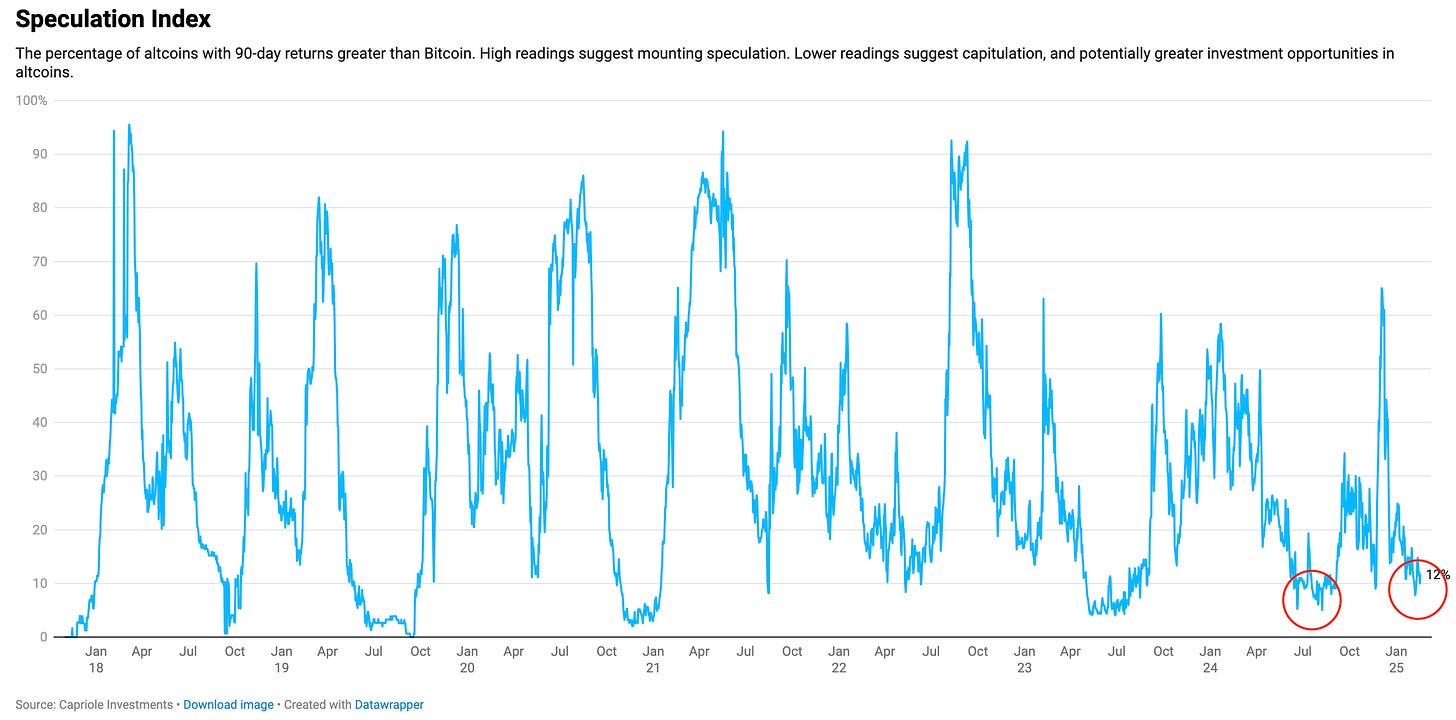

The number of alts with 90 day returns vs. BTC is now reaching levels last seen in summer 2024 when the market out in its bottom within its consolidation range (something we highlighted at the time when the easing cycle was accelerating once again).

Where do we go?

So with this fearful sentiment in mind, what does the cyclical market data suggest directionally?

First principles would suggest that risk asset performance will be catalysed with economic growth. Economic expansion leads to more corporate earnings, boosts in investor confident for growth-oriented assets, and more household earnings all else equal.

We can define economic growth using vanilla metrics like the ISM (>50).

When the ISM breaks above 50 in its 4 year cycle, BTC has its 2nd half bull market run. ISM cycle peaks coincide with market tops. ISM has now broken 50 decisively for the first time this cycle.

Investors are also more likely to rotate down the risk continuum, reflected in the Altcoin/BTC ratio driven higher during economic expansion periods (blue lines).

The Golden Age of Token Creation

One of the challenges with the alt market has been the dilution of attention and capital flows across a growing number of token opportunities. Finding consistent outperformance for many investors has been too tall of an order, driving the sentiment lower.

It seems it will get more competitive in the attention economy too.

Take Solana - where >70k tokens are launches every day with no sign of slowing down.

Emerging agent platforms will only fuel this dynamic more too.

The token creation interest should also reasonably be a function of market valuations. When the good times roll, the appetite for token creation and speculation rolls with it.

This is what we see comparing pump.fun revenue with global crypto market capitalisation.

In other words, Alts/BTC can still trend higher for structural reasons but the performance is set up to be driven by an increasingly smaller cohort of assets relative to the total asset universe.

Alpha in the current market regime

In the meantime, alpha can still be generated in select names despite rising tides no longer lifting all boats.

Since the September 2024 bottom (before the consolidation break out), 40+ names with MCAPs >$200m have outperformed BTC.

This outperformance isn’t attributable to one sector or theme either.

It is diverse with the ability for active managers to write idiosyncratic risk in a thematically diverse way.

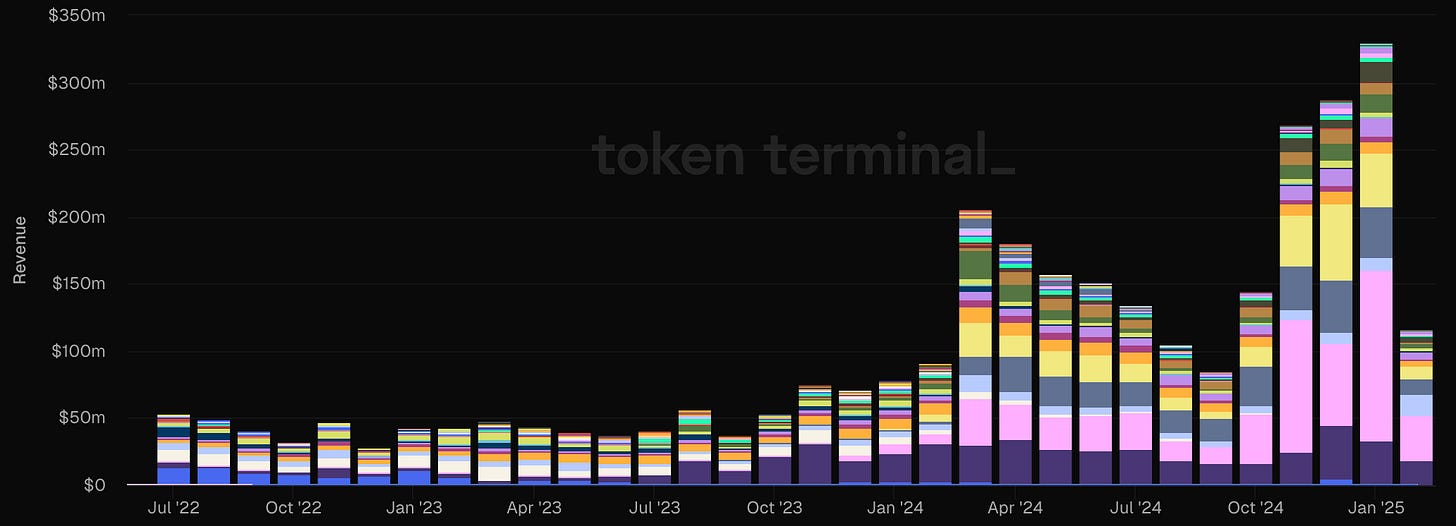

Select outperformance of these fundamental names comes at a time of increasing revenue generation.

Despite market consolidations, January set a new all-time-highs in total monthly revenue in Web3 applications ($340m+).

A number protocols are still generating 10’s millions in revenue and trading at increasingly compressed multiples.

So with the above and a zoomed out perspective, opportunities continue to manifest themselves to astute investors. You just need to know where to look.

Euler and Re7 markets are Live on Sonic:

Another week, another launch! Euler has officially launched on Sonic, and Re7 Labs is curating the main markets, currently capturing more than $9M supply in the first day!

Current markets include wS, stS, USDC.e, scUSD, scETH and wOS

Users can earn extra rEUL incentives by supplying wS and borrowing scUSD with USDC. Other incentives should be added soon to wOS/wS, stS/wS and scUSD markets

Disclaimers

The content is for informational purposes. None of the content is meant to be investment advice. Use your own discretion and independent decision regarding investments. The opinions expressed in all Re7 public research articles are the independent opinions of the authors at the time of publication and not the opinions of the affiliates of Re7.

Please see here for full disclaimers.